1 Introduction / Executive Summary

In this Leadership Compass, we evaluate customer data platforms.

The term "customer data platform," or CDP, stands for software (or a collection of software) that creates databases that enable the centralized management of customer data.

Organizations across all industrial sectors face the challenge of their customers expecting a seamless customer journey across various analog and digital touchpoints. This comprises highly individual marketing messages, recommendations, and the right information at the right point in time.

Due to scattered data silos, it is a challenge for most organizations to create 360-degree customer profiles, build customer segments, or manage customer journeys based on complete customer-related information.

Customer data platforms can help in such cases to break down data silos, aggregate information, and create compete customer profiles and segments as a basis for integrated omni-channel customer experiences across all touchpoints by connecting to first- and third-party solutions in best-of-breed technology stacks.

Thus, this Leadership Compass analyzes CDP solutions on the market to give an overview of the market positions of the vendors and the functionality of the solutions itself, with a focus on the following key aspects:

- Unified and persistent databases to access and manage customer data

- Collection, parsing, and de-duplication of customer data (received from any internal or external source)

- Identity resolution of anonymous and registered customers

- 360-degree customer profile building

- Customer segmentation

- Manage data that might be used by any internal or external process or system to ensure optimum customer experiences

- Analyses derived from combined sources of customer data

- Customer activation and customer journey optimization (either based on integrated functionality or by interfaces with third-party marketing automation systems)

In addition, this Leadership Compass evaluates the capabilities of the solutions in terms of security, functionality, deployment models, interoperability, and usability.

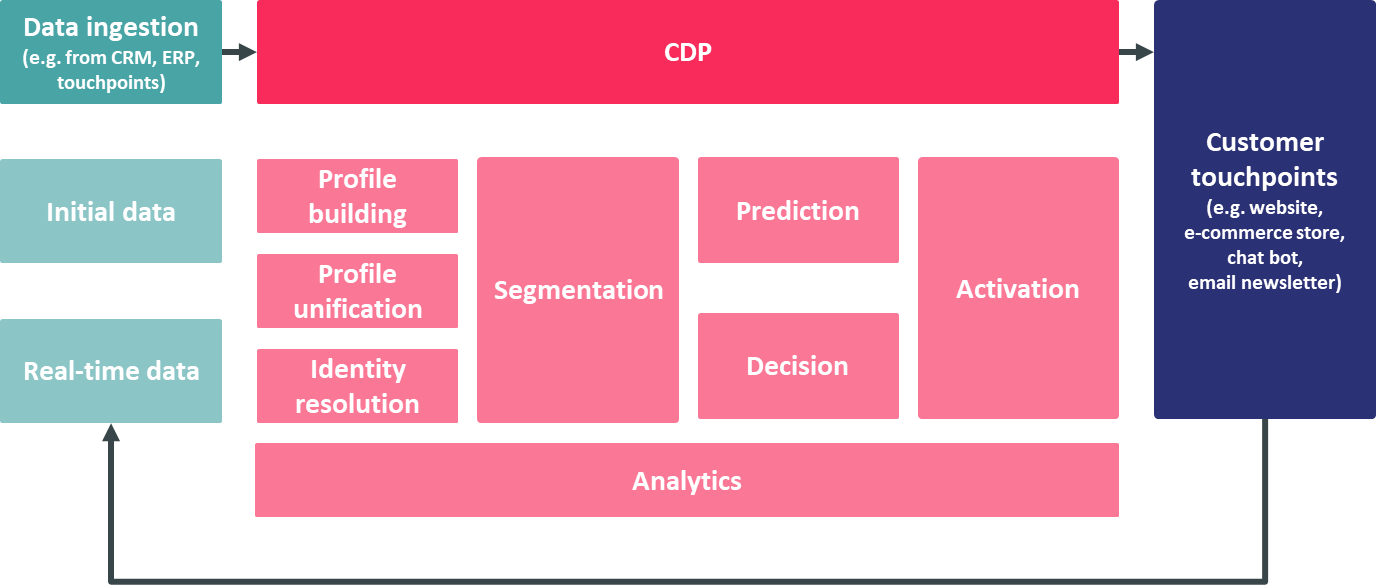

The graphic below illustrates the typical functionality of a CDP, starting with data ingestion based on various sources:

- First, profiles are built and unified (i.e., profiles that relate to the same person are merged). Furthermore, identity resolution based on unknown and known (registered) profiles (e.g., based on website visitors) ensures that customer data (e.g., tracking information) will be assigned to the right profile.

- As a next step, profile segmentation creates segments of "similar" profiles, e.g., to address a specific audience with personalized content or special offers.

- Many CDPs offer functionality to support predictions and decisions (e.g., to evaluate whether a specific segment will order a product if a 5% discount is offered at a particular step of the customer journey).

- CDPs offer functionality that support customer activation in order to manage or empower customer touchpoints.

- Typically, customer touchpoints create data that can be used by a CDP to continuously improve customer profiles and further actions (such as segmentation).

1.1 Highlights

- The market for customer data platforms is evolving quickly. The number of vendors has grown significantly within the past years - along with market volume.

- There is a heterogenous situation in terms of vendors:

- On one hand, there are large and established vendors that have completed their offerings by adding customer data platforms to their portfolios. In many cases these solutions are parts of complete software suites that are focused on seamless and complete customer experiences.

- On the other hand, there are many specialist vendors that have been founded during the last five to ten years. In many cases these are single-product vendors that provide standalone CDP solutions that are a good fit for existing best-of-breed technology stacks in organizations.

- Most vendors have a background and focus on marketing and sales. On the other hand, CDP is an overarching topic. This leads to the fact that vendors that were focused on other areas (such as ERP) in the past have started offering CDP solutions.

- Most vendors have very complete and ambitious road maps that are focused mainly on a higher grade of automation (e.g., related to prediction and decisioning, supported by machine learning), an even more seamless and complete integration into heterogenous technology stacks, and, continuous development when it comes to customer activation measures, considering new channels and touchpoints such as IoT.

- All solutions offer graphical no-code user interfaces that are made for nontechnical users, even when it comes to data management or machine learning configuration. In addition, some solutions allow customization and coding (e.g., Python or SQL) by technical experts.

- Privacy is a key topic for most vendors, due to legislation and regulations and customer expectations.

- There is a clear trend and necessity for many organizations to move from third-party data to first-party customer data. This is one of the key drivers when it comes to customer data management.

- Most solutions can be deployed as cloud-based SaaS solutions; few solutions are available for on-premises deployment. Many solutions rely on cloud technology such as AWS, Microsoft Azure, or Google Cloud and are flexible when it comes to customer requirements, e.g., when instances in specific regions are required.

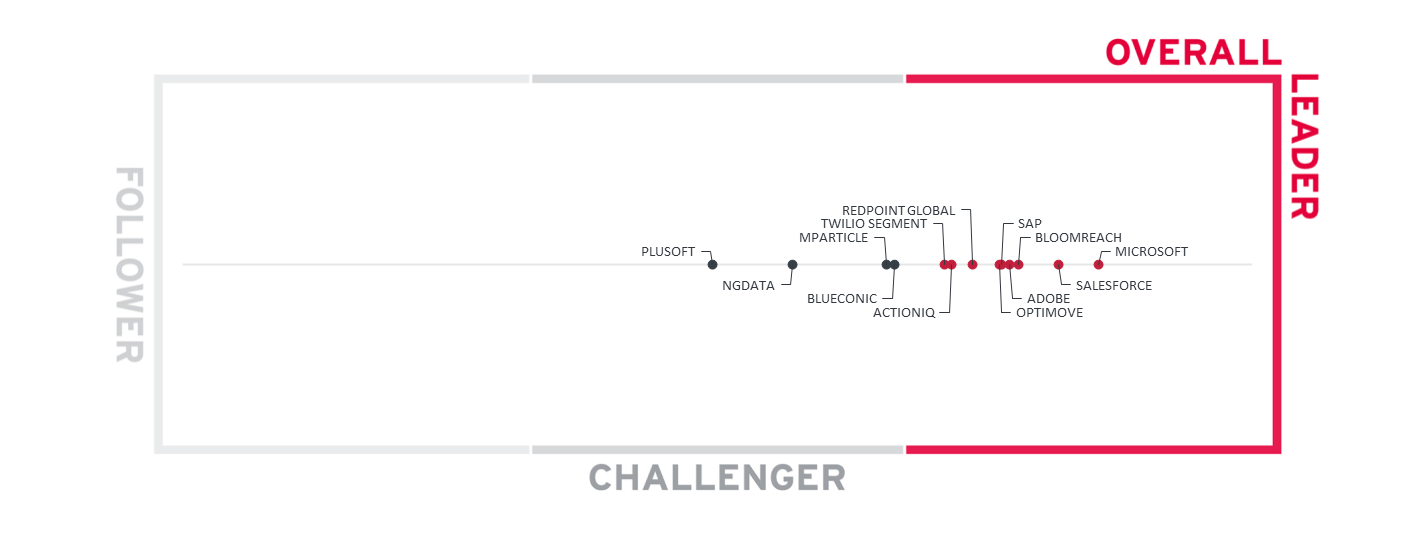

- Overall leaders are (in alphabetical order) ActionIQ, Adobe, Bloomreach, Microsoft, Optimove, Redpoint Global, Salesforce, SAP, Twilio Segment

- Product leaders are (in alphabetical order) ActionIQ, Adobe, Bloomreach, BlueConic, Microsoft, Optimove, Redpoint Global, Salesforce, Twilio Segment

- Innovation leaders are (in alphabetical order) ActionIQ, Bloomreach, Optimove, Microsoft, Redpoint Global, Salesforce

1.2 Market Segment

Challenges as a basis for a business case

Customer data platforms address several challenges that many organizations are currently facing:

- Driven by digitalization, organizations face the challenge that customer data is managed and stored in many different systems by many different departments, such as sales, marketing, service management, and many others. Based on such data silos, it is a challenge to have a complete view of all attributes that are relevant to fully understanding a customer, customer segments, or the effectiveness and efficiency of various marketing measures and touchpoints.

- Furthermore, a great customer experience is key for many organizations. In many cases, an outstanding customer experience might even be more important than the quality of the product itself. This requires personalization, appropriate next best actions in a customer journey, recommendations with an added value, real-time experiences, and a smooth and seamless integration of various touchpoints, such as digital and mobile devices, IoT, and also "real world" experiences when visiting a retail store. Orchestration of a continuously growing quantity of channels, devices, and touchpoints requires real-time availability of high-quality customer data.

Customer data platforms can help address these challenges. Nevertheless, a CDP project requires more than just IT. To break data silos, all relevant departments must cooperate based on a common business case. In general, this requires C-level involvement to consider the full picture.

On the other hand, typically not all aspects and requirements are fully clear when creating such a business case. Furthermore, customer-centric approaches are subject to frequent change, especially due to continuous evolution and disruption related to consumer trends. This means that an agile approach is highly recommended, and a flexible and adaptable CDP solution is key to success.

Continuous improvement of data quality and customer experience

As mentioned above, agility is key to success when it comes to customer data management and amazing customer experience. And success in each area depends on the other. Independent of the project part of selection, implementation, and rollout of a CDP system, the process of using a CDP is highly agile and can accelerate continuous improvement of both data quality and customer experience.

Every customer touchpoint that is powered by data from a CDP delivers insights related to customers who interact with that specific touchpoint.

Example: A specific offer is presented to a customer segment that has been defined (automatically) in a CDP based on existing data such as age, previous purchases, and preferred device types. Based on previous learnings and insights, the organization prepares this offer which is considered a good fit for this segment. Based on user behavior (clicks, purchases, and other metrics), the CDP receives tracking data to measure the success of this campaign - as a basis for both optimization of future segmentation and optimization of the campaign itself. A/B testing (e.g., based on different graphics or images) can be a further method to continuously optimize customer experience based on real-world experience.

The above example shows how data impacts user experience and vice versa - always with the aim of continuous improvement. Such scenarios are typical when it comes to the use of a CDP. The various solutions support such improvement in many ways with smart automated functionality, e.g., when it comes to segmentation, prediction, or decisioning, and supported by machine learning in many cases.

System landscape

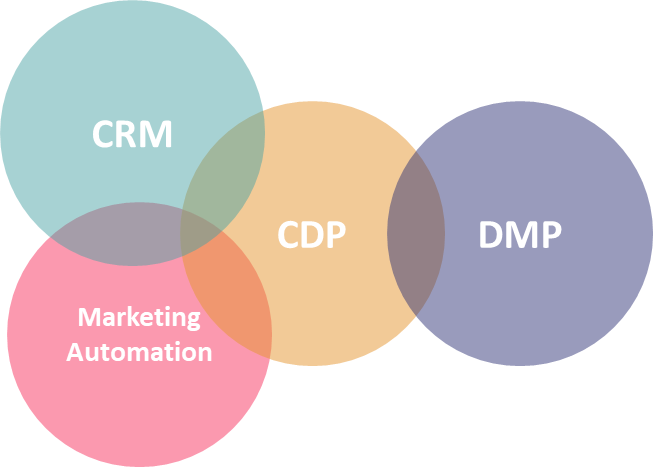

It is quite important to distinguish between different system types that are relevant in the area of customer data and experience, although the borders are often blurry. At KuppingerCole, we define these types as follows:

- CDP (Customer Data Platform) - software (or a collection of software) that creates databases that enable the centralized management of customer data (inclusion and exclusion criteria described more detailed in chapter 1.4)

- CRM (Customer Relationship Management) System - software that manages customer data from a range of different communication channels, such as telephone, email, live chat, or social media. CRM systems may have some overlap with CDPs in functionality. The primary aim of a CRM system is to support sales, e.g., by managing a sales funnel or helping develop quality leads, while a CDP system delivers a more complete view of the customer beyond the sales cycle - even, for instance, related to identity resolution in case of anonymous users of a website.

- DMP (Data Management Platform) - a software platform that is used to collect and manage all kinds of data, not specifically related to customers. Such solutions are more generic than CDPs and not focused on optimizing the customer experience or insights that are specifically related to the customer domain.

- Marketing Automation - software or a collection of tools that helps manage and automate orchestration of customer journeys across multiple touchpoints. Many CDP solutions include features that might be part of marketing automation solutions as well, such as journey builders. Alternatively, CDPs might be connected to third-party marketing automation solutions to deliver and receive customer data to both ensure a personalized customer experience and gain customer insights.

Every organization might consider different tool stacks. In general, there is no right or wrong, as this depends on individual requirements and an individual status quo. In some cases, an integrated single-vendor solution that comprises CRM, CDP, and marketing automation, for example, might be reasonable. In other cases, a stand-alone CDP solution might be the right choice to connect an existing best-of-breed technology stack - with the advantage of being more flexible and less dependent on a single vendor. Of course, various "hybrid" approaches between single-vendor and best-of-breed are possible as well, as the comprehensive platforms that cover a broad band of functionality come with extensive and flexible interfaces and connectors as well.

Selection and introduction of a CDP solution

KuppingerCole recommends the following strategic approach for moving toward a Customer Data Platform, which should be mapped to meaningful business, conceptual, technical, and project planning measures.

- Create a business case to evaluate whether a CDP implementation could be an option to meet a strategic aim (a CDP is not an end in itself).

- Involve all stakeholders that are relevant to making the project a success.

- Use requirements engineering methods to create user stories or use cases to understand the business requirements of all stakeholders in a nontechnical way.

- Prioritize the requirements in an ordered product backlog.

- Don't create a "monolithic" project. It is OK to specify as much as possible at a certain point in time. If some future requirements are not totally clear yet, specify them as much as possible. Digitalization is subject to change. During and after a project, further requirements will arise - this is normal. Embrace change.

- Consider the teams and resources that will be needed at the project level and later at the process level (business as usual). Consider the required skills as well and map them with the functionality of a CDP solution (e.g., the skills of data analysts vs. skills of marketers).

- Consider your product backlog when evaluating solutions and check how they meet the defined requirements. Consider especially the required interfaces/connectors and whether you require a stand-alone CDP that extends your existing best-of-breed technology stack or if a comprehensive platform that brings both CRM and marketing automation capabilities will better meet your needs.

- Check the flexibility of the solutions. Even if a solution perfectly meets your requirements, these requirements will change over time. Flexibility of both vendor and solution is key.

- Evaluate how you will measure success of the project. Evaluate how the solution help to meet your strategic goals. A business case review plan might help here, to evaluate success after given periods of time.

- Aim for continuous improvement during business as usual based on a PDCA cycle (plan - do - check - act). A CDP will bring new insights into customer needs and expectations. Considering these needs in your marketing strategy and operational execution is key. A flexible CDP will help meet these expectations.

1.3 Delivery Models

Customer data platforms are deployed based on various delivery models. Ideally, they are scalable - a main requirement of many organizations, as the number of managed customer profiles and the associated amount of data will increase significantly over time.

On the other hand, there are privacy and information security requirements that must be considered, based on local or global regulations, legislation, and standards.

In general, these deployment models play a major role when it comes to customer data platforms:

- Multi-tenant public cloud services

- Single-tenant public cloud services where updates, patches, etc., are deployed by the service provider across all tenants with full automation, which requires adequate software architectures (segregation of customizations and data from application code)

- Single-tenant services that can operate in various deployment models, i.e., in private or public clouds or even on-premises, as long as they can be operated in full as-a-service model where updates, patches, etc., are deployed by the service provider across all tenants with full automation, which requires adequate software architectures (segregation of customizations and data from application code)

- Furthermore, delivery must meet the expectations regarding licensing models (pay-per-use), elasticity, and scalability, i.e., flexible scaling of the service. Beyond that, as mentioned above, we expect modern software architectures, which are the foundation for flexibility in deployment.

Overall, we prefer solutions that can be deployed and orchestrated flexibly, supporting different deployment models. Flexible deployment options give customers the opportunity to consider their individual requirements, but also enable support for more complex scenarios such as geographically dispersed deployments and hybrid scenarios.

This Leadership Compass expects the availability of as-a-service deployments in general.

1.4 Required Capabilities

The solutions must have various capabilities to ensure that the key requirements below can be fulfilled:

- Unified and persistent databases to access and manage customer data

- Collection, parsing, and de-duplication of customer data (received from any internal or external source)

- Identity resolution of anonymous and registered customers

- 360-degree customer profile building

- Customer segmentation

- Manage data that might be used by any internal or external process or system to ensure optimum customer experiences

- Analyses derived from combined sources of customer data

- Customer activation and customer journey optimization (either based on integrated functionality or interfaces with third-party marketing automation systems)

In addition:

- Data that is managed in customer data platforms is typically collected from various customer touchpoints, such as an organization's website, e-commerce systems, social media, chat or voice bots, or manual customer interactions that are stored in customer relationship management systems. Customer data platforms must provide interfaces and connectors to collect such data.

- On the other hand, the data that is stored and managed in customer data platforms can be used to optimize the customer journey across multiple touchpoints and ensure a personalized and fit-for-purpose customer or consumer experience. Therefore, customer data platforms are typically connected to marketing automation solutions or similar systems - and must provide appropriate interfaces and connectors.

- A customer data platform is a central hub that enables the segmentation, clustering, transformation, and unification of data that has been gathered. In this way, big data can be transformed into intelligent data as a basis for further activities, such as predictive marketing and further analysis.

Furthermore, aspects such as data protection, information security, regulatory compliance, and (local) legislation must be considered by customer data management platforms.

The mode of deployment (e.g., on premises or software as a service) is a further criterion when it comes to the evaluation of such platforms.

The focus is on solutions that enable customer data management based on data input from various systems and allow data output to a wide range of marketing (automation) use cases to ensure an optimum personalized customer experience.

The main capabilities of such customer data platforms are:

-

Data input and output

-

Centralized database to store the following data from any internal or external source:

- Customer profiles, consisting of personally identifiable information (PII) (e.g., age, gender)

- Transactional data (e.g., purchases, returns)

- Customer behavior (e.g., impressions, interactions)

- Customer feedback (e.g., ratings, complaints)

-

Data can be retrieved from various internal and external resources

-

Data can be provided to various internal and external resources

-

Support for relevant communication and data format standards

-

-

Connectors/interfaces

- Databases, data warehouses, or data lakes

- Customer relationship management (CRM) systems

- Consumer identity and access management (CIAM) systems

- Consent and privacy management (CPM) systems

- E-commerce systems

- Marketing automation platforms

- Web analytics

- Social media

- Data management platforms

- Online advertising

- BI platforms

-

Collect, cleanse, and enrich data

-

Identity resolution and mapping with consent

-

Device (and cookie) matching

-

Enable a structured data basis to be built for enhancing and automating customer journeys, such as

- Predictive marketing

- Recommendation management

- Personalized campaigns

- Lead nurturing

-

Report generation, e.g.:

- Customer activities

- Trends

- Conversion

- A/B testing

- Individual reports on demand

-

Privacy and information security capabilities to ensure compliance

- Data encryption (at rest and in transit)

- Secure APIs

- Ability to pseudonymize and/or anonymize customer data

- Ability to respond to data subject access requests (DSARs)

- Ability to export specific customer data upon request

- Ability to delete specific customer data upon request

- Features that enhance customers' ability to comply with regulations such as EU GDPR, CCPA, CPRA, PIPEDA, HIPAA, etc.

- Strong authentication for customer administrators and users

- Role- or attribute/policy-based access controls for customer administrators and users

-

Support capabilities

We expect solutions to cover a majority of these capabilities, at least at a good baseline level.

Additional capabilities might bring added value and as such are often part of customer data platforms, such as:

-

Additional connectors/interfaces

- IoT

- Product information management systems

- Tag management systems

-

Analytics ("360-degree understanding")

-

Based on structured data, various types of analytics can be used to:

- Review marketing and sales activities

- Track customer behavior

- Automatically create KPIs

- Continuously improve customer experience based on insights

-

Search/filter capabilities

-

Individual dashboards that can be easily configured

-

Interfaces related to analytics

-

-

Machine learning

-

Machine learning capabilities can support the following efforts:

- Data structuring and classification

- Recommendation management

- Personalization

- Predictive marketing

-

-

Intuitive user interface that facilitates data management for nontechnical users

-

Flexible deployment models

-

Data management consultancy

-

Developer capabilities

Exclusions from this Leadership Compass:

- Vendors that provide only data management platforms (DMPs) without as strong a focus on customer data will not be considered in this report.

- Vendors that are mainly focused on marketing automation and/or customer relationship management systems will not be considered.

- Vendors that have multiple products with heterogeneous architectures and little or no integration regarding deployment, operations, architecture, UI/UX, APIs, etc., will not be considered.

- Vendors whose products do not meet the definition of customer data platforms will not be considered for this Leadership Compass.

- Vendors without active deployments with customers (e.g., start-ups in stealth mode) will not be considered.

- Solutions that lack a comprehensive set of interfaces and connectors will not be considered.

- Solutions that are targeted at only employees/business partners or only customers/consumers will not be considered.

However, there are no further exclusion criteria, such as revenue or number of customers. We cover vendors from all regions, from start-ups to large companies.

2 Leadership

Selecting a vendor of a product or service must not only be based on the information provided in a KuppingerCole Compass. The Compass provides a comparison based on standardized criteria and can help identifying vendors that shall be further evaluated. However, a thorough selection includes a subsequent detailed analysis and a Proof of Concept of pilot phase, based on the specific criteria of the customer.

Based on our rating, we created the various ratings. The Overall rating provides a combined view of the ratings for

- Product

- Innovation

- Market

2.1 Overall Leadership

Considering product, innovation, and market leadership, we see that Microsoft is in the lead, followed by Salesforce and Bloomreach, as they provide comprehensive and powerful CDP solutions, based on a strong market position and innovative capabilities.

Further vendors placed in the Overall Leader segment include, in alphabetical order, ActionIQ, Adobe, Optimove, Redpoint Global, SAP and Twilio Segment. All of them provide strong offerings. Of course, every solution and vendor brings its own strengths and challenges, which are described later in this report.

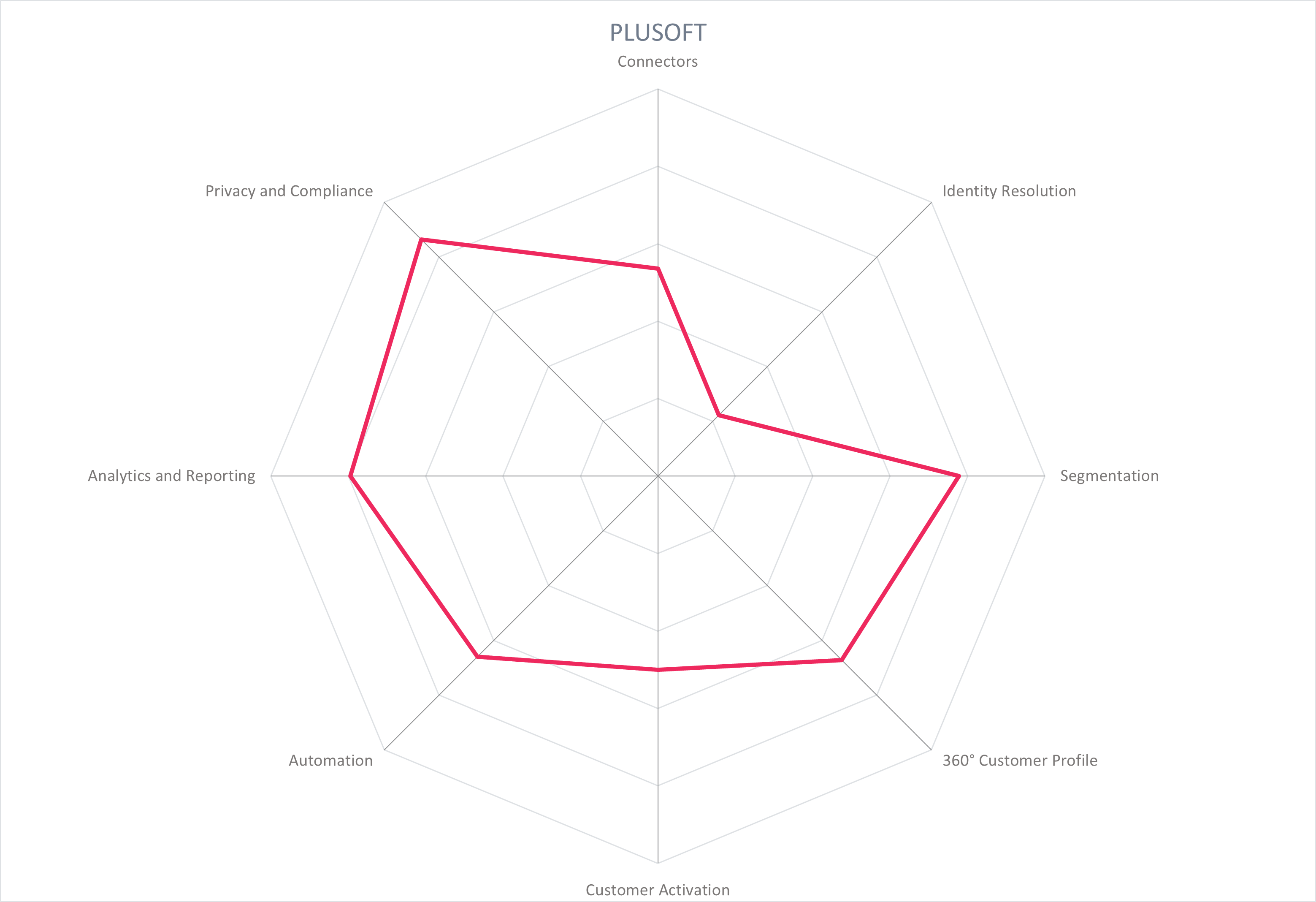

In the challenger section we see the following vendors, again in alphabetical order: BlueConic, mParticle, NGDATA and Plusoft. Some of them are smaller vendors or relatively new to the CDP market. Being a challenger does not necessarily mean that the capabilities are weaker compared to the vendors that have been classified as leaders. In many cases, it is also the fact that a vendor is relatively new to the market or that it is focused on very specific topics within the CDP sector that leads to a different overall ranking compared to the leaders.

In many cases, challengers have very strong road maps. This means that it is highly recommendable to stay up-to-date and frequently check news and press releases of these vendors especially.

Overall Leaders are (in alphabetical order):

- ActionIQ

- Adobe

- Bloomreach

- Microsoft

- Optimove

- Redpoint Global

- Salesforce

- SAP

- Twilio Segment

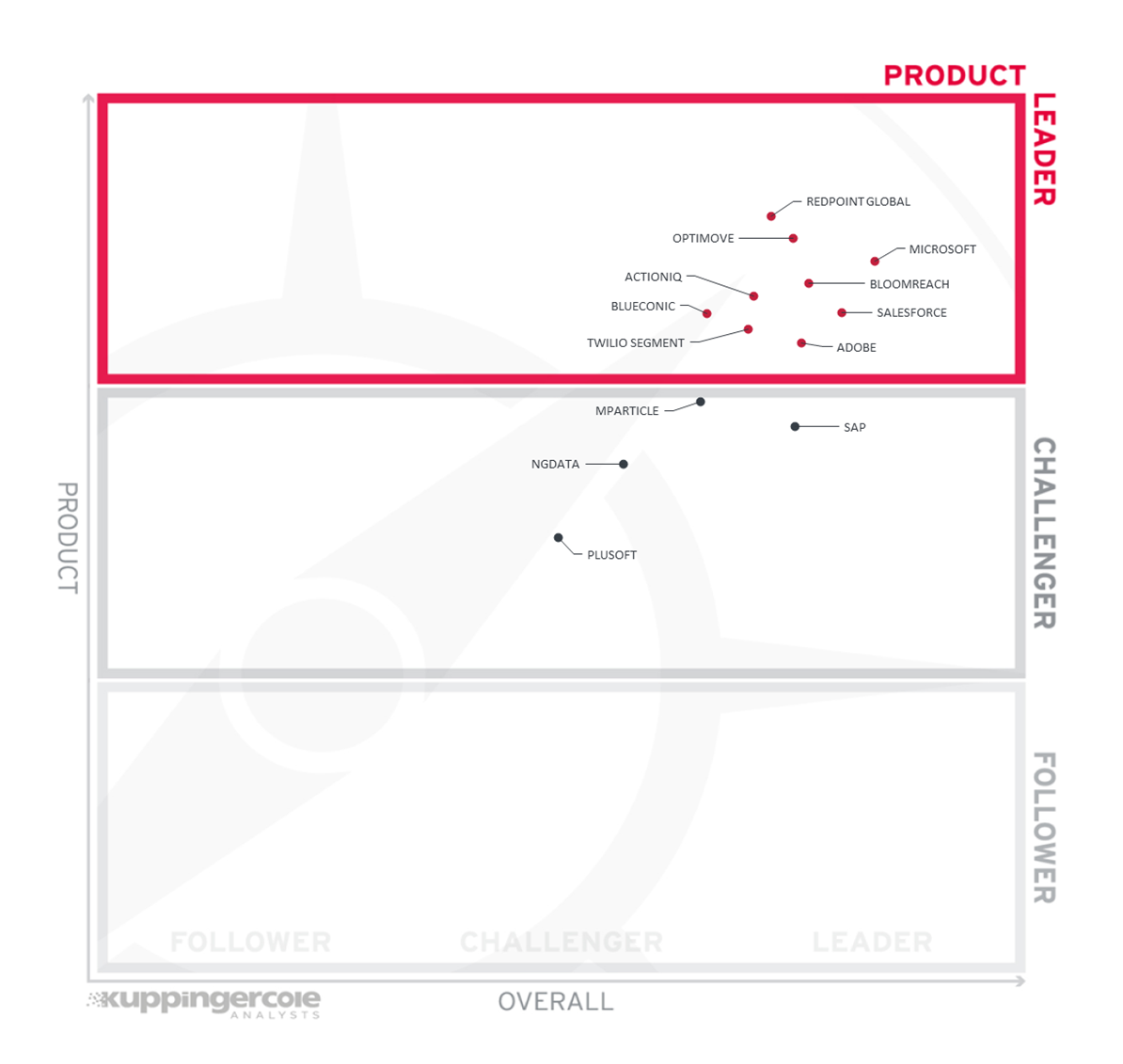

2.2 Product Leadership

Product Leadership is the first specific category examined below. This view is mainly based on the analysis of service features and the overall capabilities of the various services. Product Leadership is where we examine the functional strength and completeness of services.

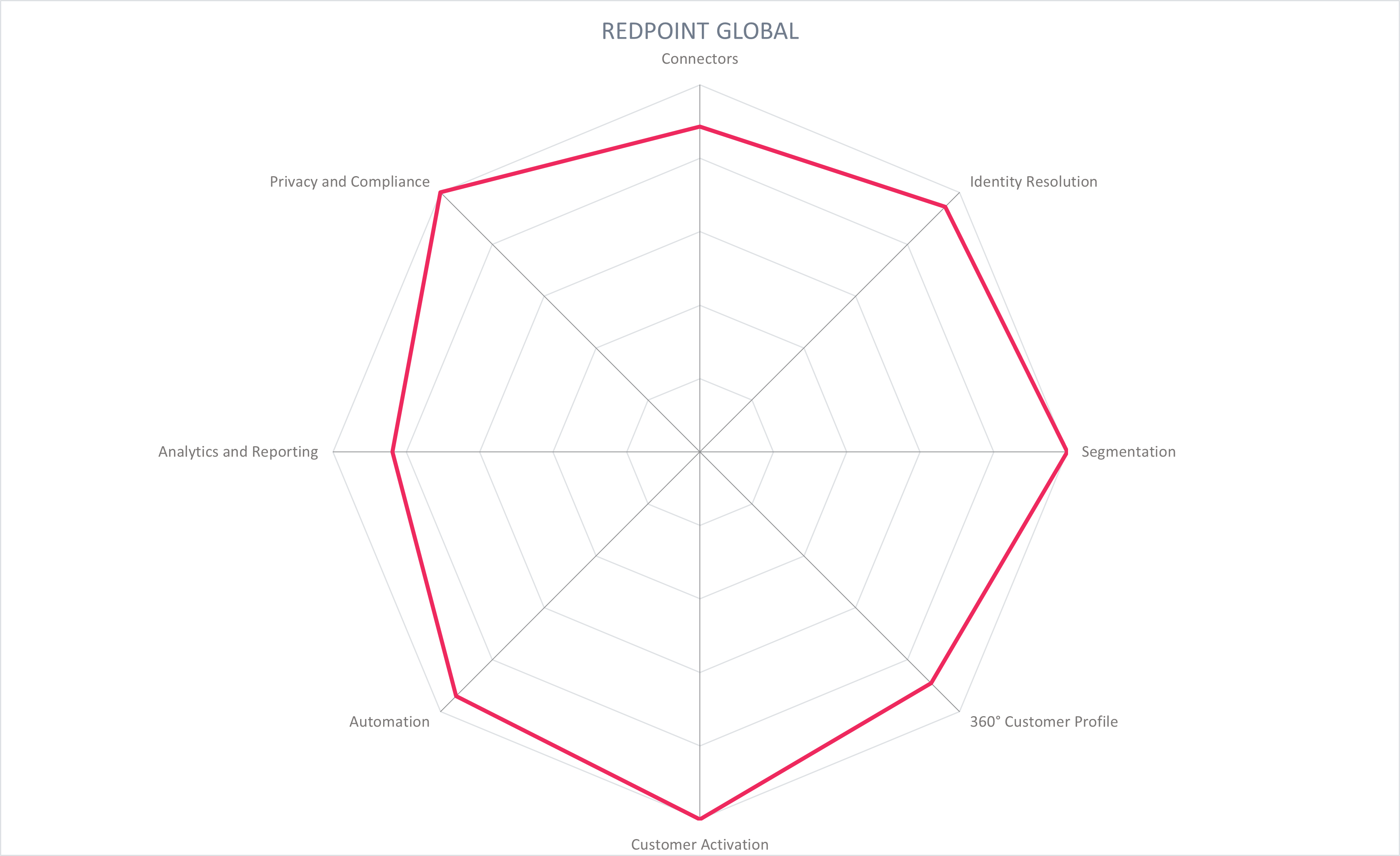

When it comes to product leadership, we see Redpoint Global on the top, closely followed by Optimove. Both deliver CDP solutions with a comprehensive feature set that is suitable for many use cases and is strong in all product-related criteria that we consider in this leadership compass.

Redpoint Global has strengths especially in its very comprehensive feature set. Optimove has great capabilities, combined with a high usability.

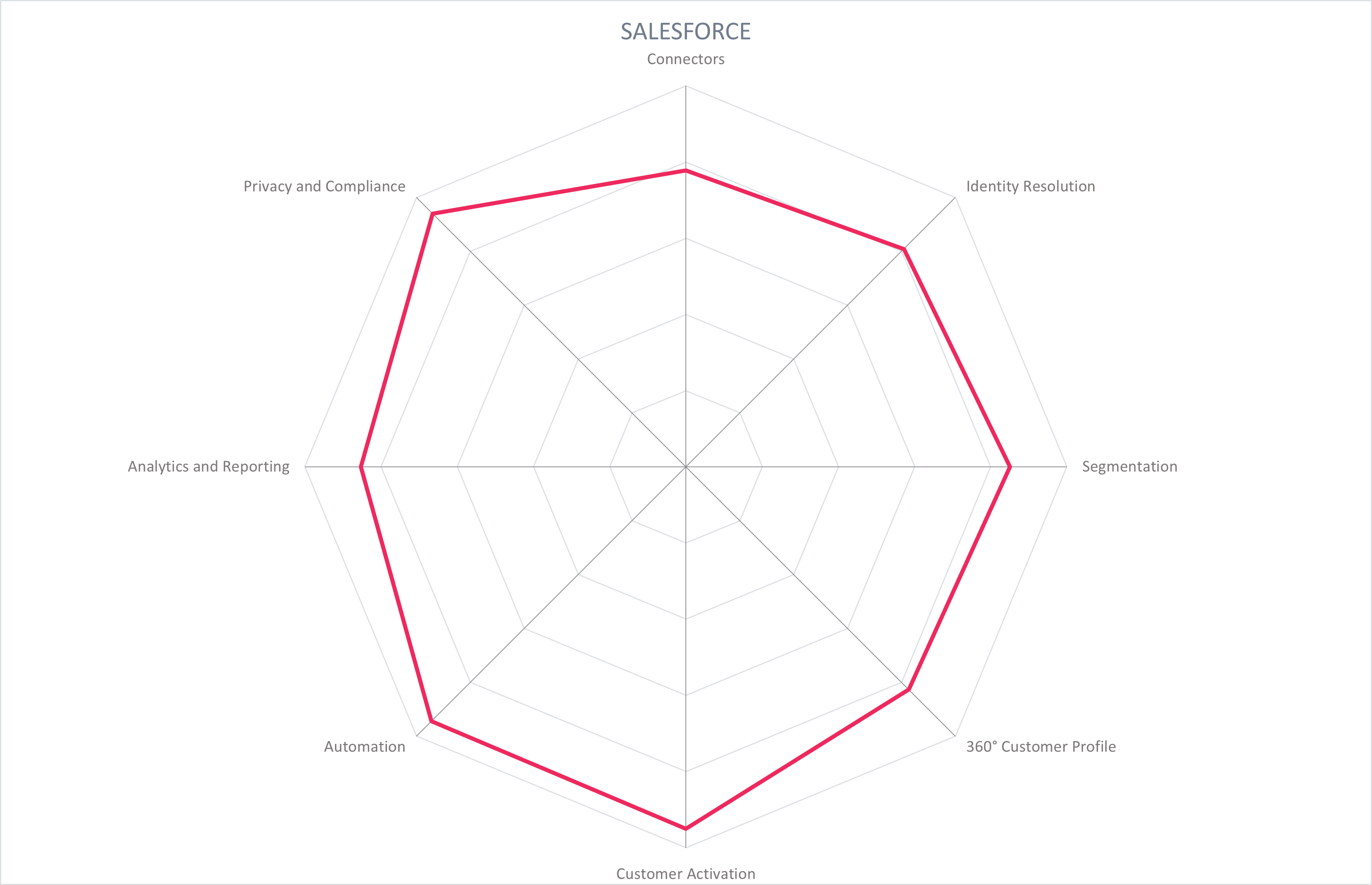

Other vendors, such as Adobe, Microsoft, and Salesforce, benefit from strong CDP capabilities and a seamless integration in the product portfolio of each vendor.

Other product leaders, such as ActionIQ, Bloomreach, and BlueConic, are focused on the CDP segment (some of them are single-product vendors) and therefore are really specialized on this topic with a clear focus.

Twilio Segment is one of the product leaders with a strong focus on data quality and a consequent best-of-breed approach.

There are several challengers in our report that have strong product capabilities as well. mParticle and NGDATA both have strong capabilities when it comes to customer profiles, identity resolution, and segmentation. Both continuously develop in terms of customer activation capabilities (e.g., customer journey builders, etc.).

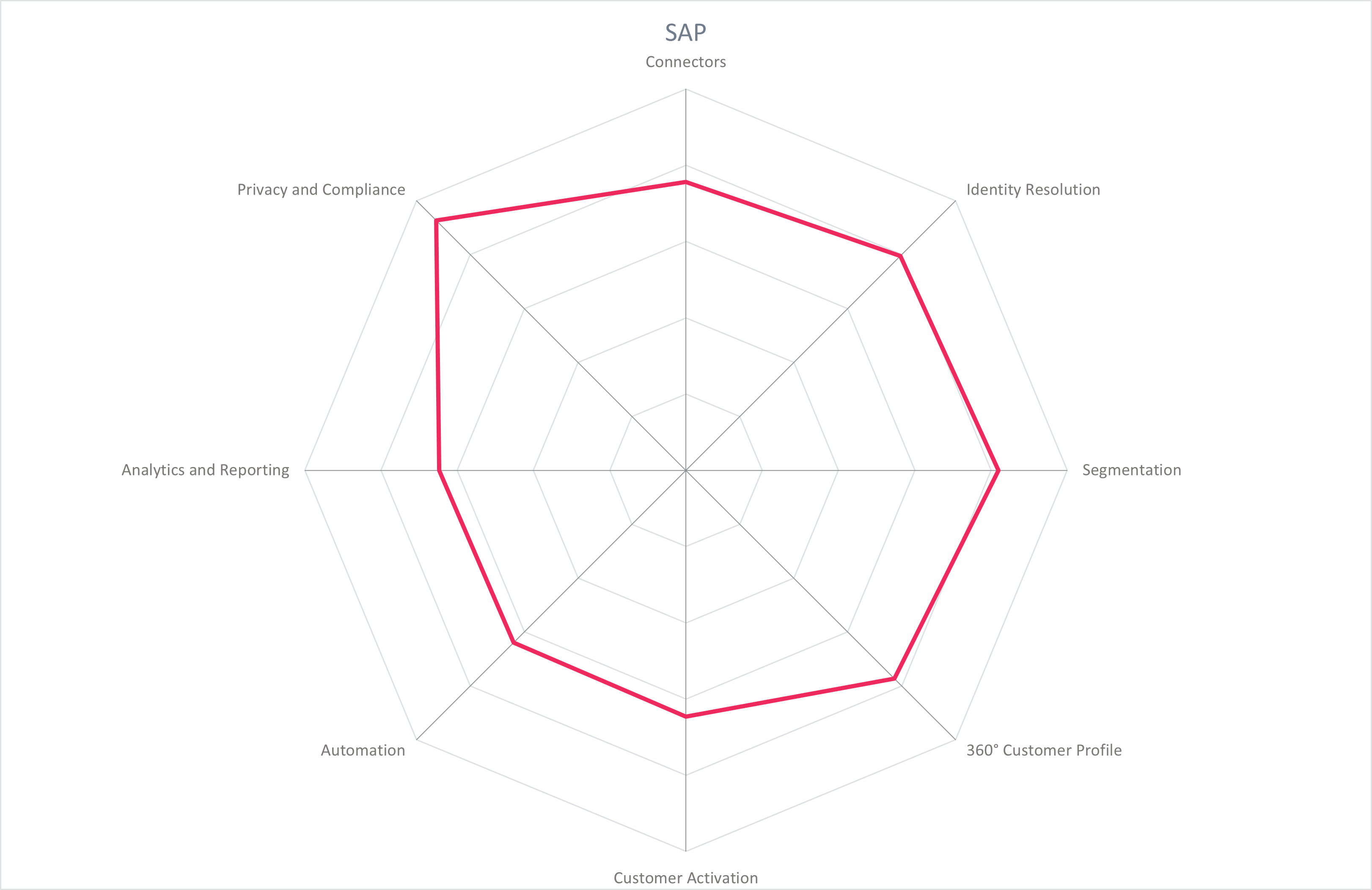

SAP is relatively new to the CDP market. The solution already has strong capabilities, in combination with a great road map. A USP of SAP's solution is the fact that SAP has its roots in the ERP sector, leading to a highly interesting CDP approach.

Plusoft is a vendor that is somewhat different, as its solution combines CDP functionality with an interesting product suite with a focus on CRM, Customer Journey Orchestration, and a Learning Platform. Furthermore, its services comprise marketing and sales operations as well.

Product Leaders (in alphabetical order):

- ActionIQ

- Adobe

- Bloomreach

- BlueConic

- Microsoft

- Optimove

- Redpoint Global

- Salesforce

- Twilio Segment

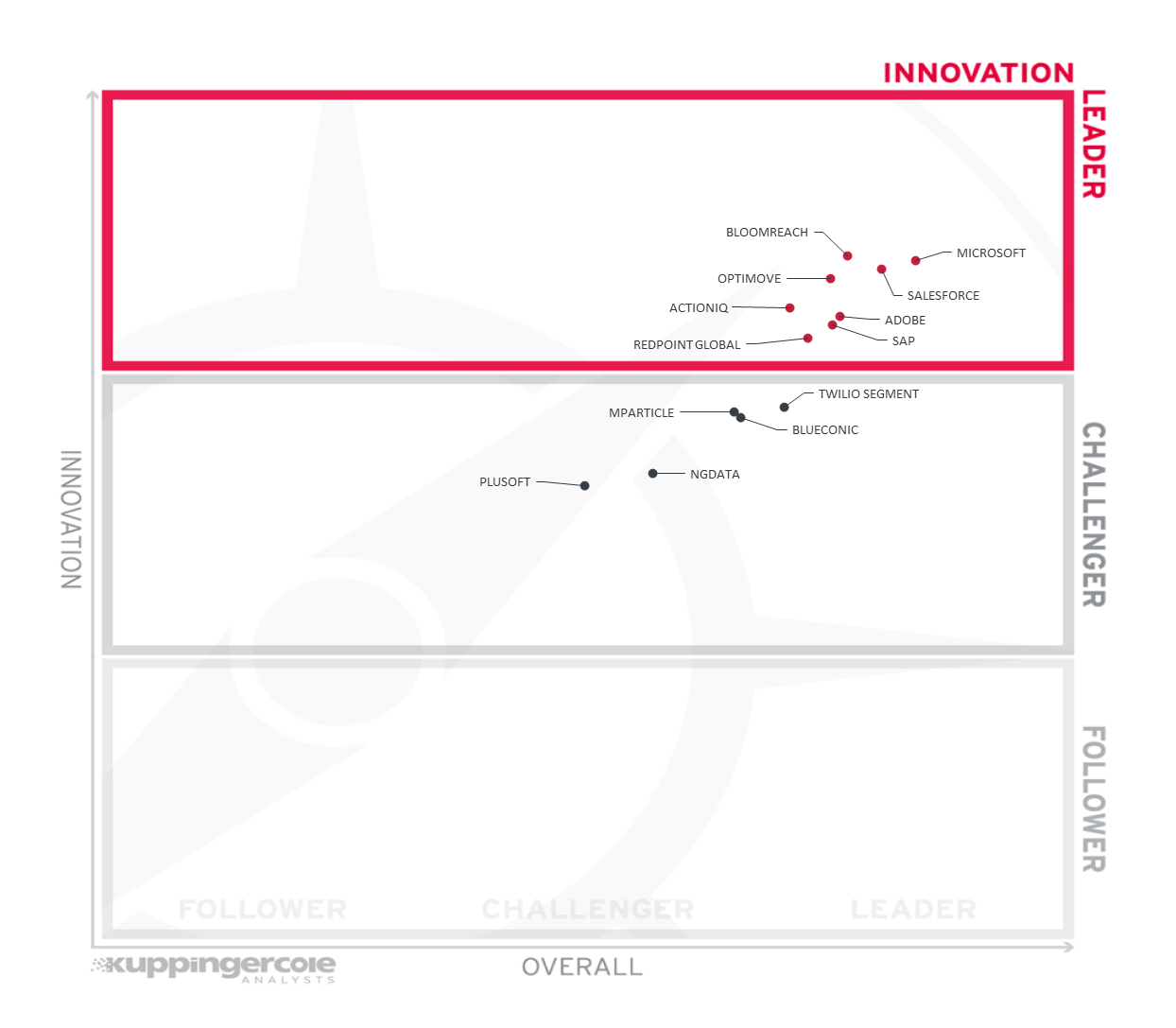

2.3 Innovation Leadership

Next, we examine innovation in the marketplace. Innovation is, from our perspective, a key capability in all IT market segments. Customers require innovation to meet evolving and even emerging business requirements. Innovation is not about delivering a constant flow of new releases. Rather, innovative companies take a customer-oriented upgrade approach, delivering customer-requested and other cutting-edge features, while maintaining compatibility with previous versions.

When it comes to innovation leadership, we see that there are some very large vendors in the lead that are focused on a wide product range (including CDP), such as Microsoft,Salesforce, Adobe and SAP. On the other hand, there are smaller vendors with a more narrow focus on the CDP segment in the lead as well, such as ActionIQ, Bloomreach, Optimove, and Redpoint Global.

Looking at the challenger section, again, there is a mix of larger and smaller vendors. It is notable that the smaller vendors especially often provide highly innovative features ― often based on concrete customer requests based on "real-life problems."

CDP is a highly agile segment. Therefore it is not a surprise that most vendors rely on continuous deployments based on SaaS solutions to offer innovations frequently to their customers.

Innovation Leaders (in alphabetical order):

- ActionIQ

- Adobe

- Bloomreach

- Optimove

- Microsoft

- Redpoint Global

- Salesforce

- SAP

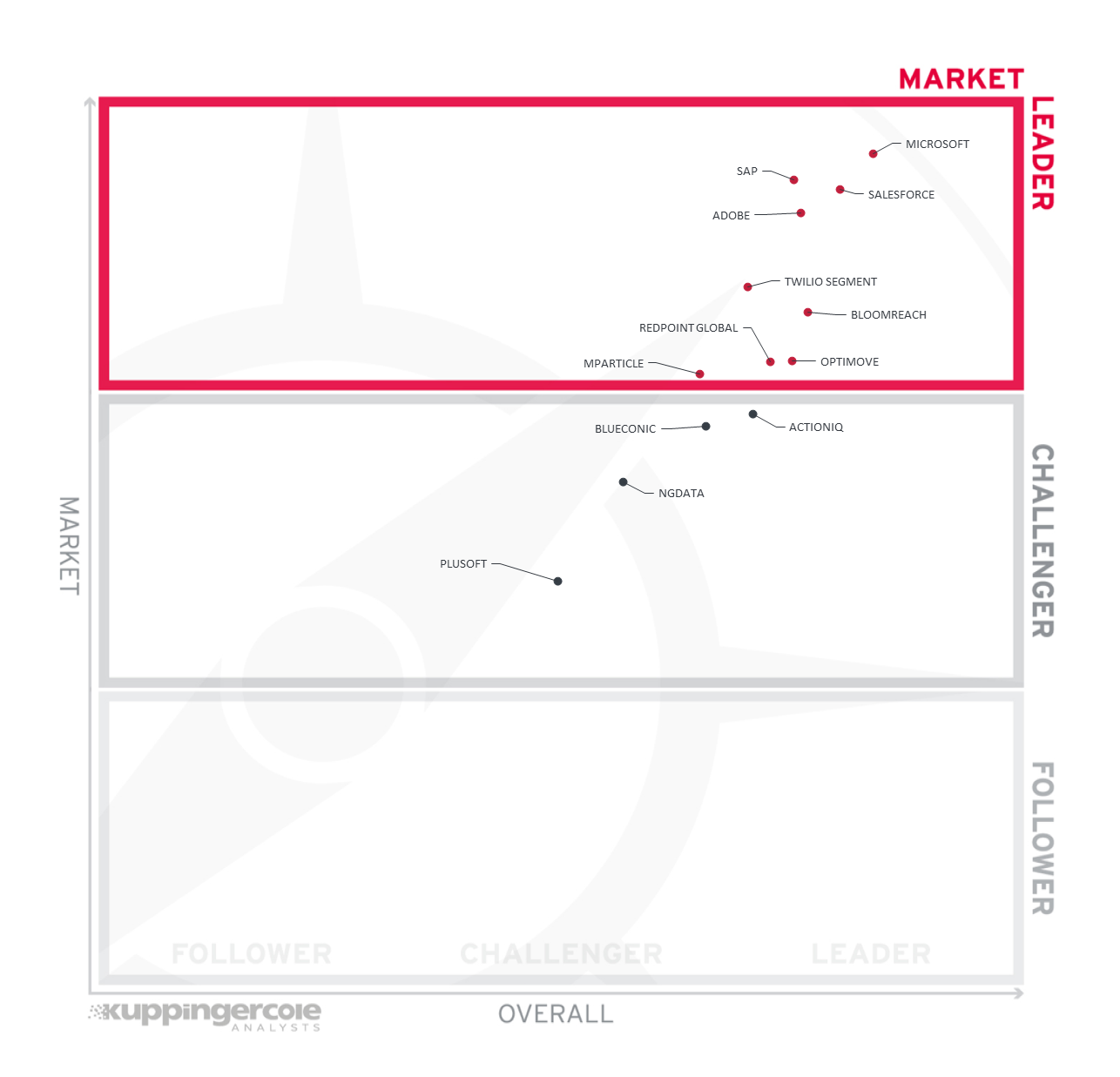

2.4 Market Leadership

Lastly, we analyze Market Leadership. This is an amalgamation of the number of customers, number of transactions evaluated, ratio between customers and managed identities/devices, the geographic distribution of customers, the size of deployments and services, the size and geographic distribution of the partner ecosystem, and financial health of the participating companies. Market Leadership, from our point of view, requires global reach.

Market Leadership, as indicated, focuses on global reach and partner ecosystems as well as the number of customers and other factors. Thus, it is no surprise seeing several of the well-known, established, and large players in the leader segment. Microsoft again takes the lead, followed by (in alphabetical order) Adobe, Salesforce, and SAP.

Furthermore, we see the following vendors in the leading section (again in alphabetical order): Bloomreach, mParticle, Optimove, Redpoint Global, and Twilio Segment. Compared to the very large players, these vendors have a stronger focus on the CDP market (relative to their overall business).

All other vendors (again in alphabetical order) are positioned in the challenger section: ActionIQ, BlueConic, NGDATA, and Plusoft.

These vendors are either smaller, new to the market, or focused on specific geographic regions.

Market Leaders (in alphabetical order):

- Adobe

- Bloomreach

- Microsoft

- mParticle

- Optimove

- Redpoint Global

- Salesforce

- SAP

- Twilio Segment

3 Correlated View

While the Leadership charts identify leading vendors in certain categories, many customers are looking not only for a product leader, but for a vendor that is delivering a solution that is both feature-rich and continuously improved, which would be indicated by a strong position in both the Product Leadership ranking and the Innovation Leadership ranking. Therefore, we provide the following analysis that correlates various Leadership categories and delivers an additional level of information and insight.

3.1 The Market/Product Matrix

The first of these correlated views contrasts Product Leadership and Market Leadership.

Vendors below the line have a weaker market position than expected according to their product maturity. Vendors above the line are sort of "overperformers" when comparing Market Leadership and Product Leadership. It is probably not a surprise that mainly the big vendors are positioned above the line.

All the vendors below the line are underperforming in terms of market share. However, we believe that each has a chance for significant growth. We especially note that these vendors are generally small vendors ― many of them with strong products, and some of them relatively new to the market.

In the upper right segment, we find a group of vendors that score well in both Product Leadership and Market Leadership. These are all also placed among the Overall Leaders.

More interestingly, to the middle-top, we find SAP, which has a strong market position but is not yet a product leader ― which might change in the future due to a very ambitious and innovative road map.

In the middle and middle-right segment, we see mainly smaller vendors and/or vendors that are relatively new to the market.

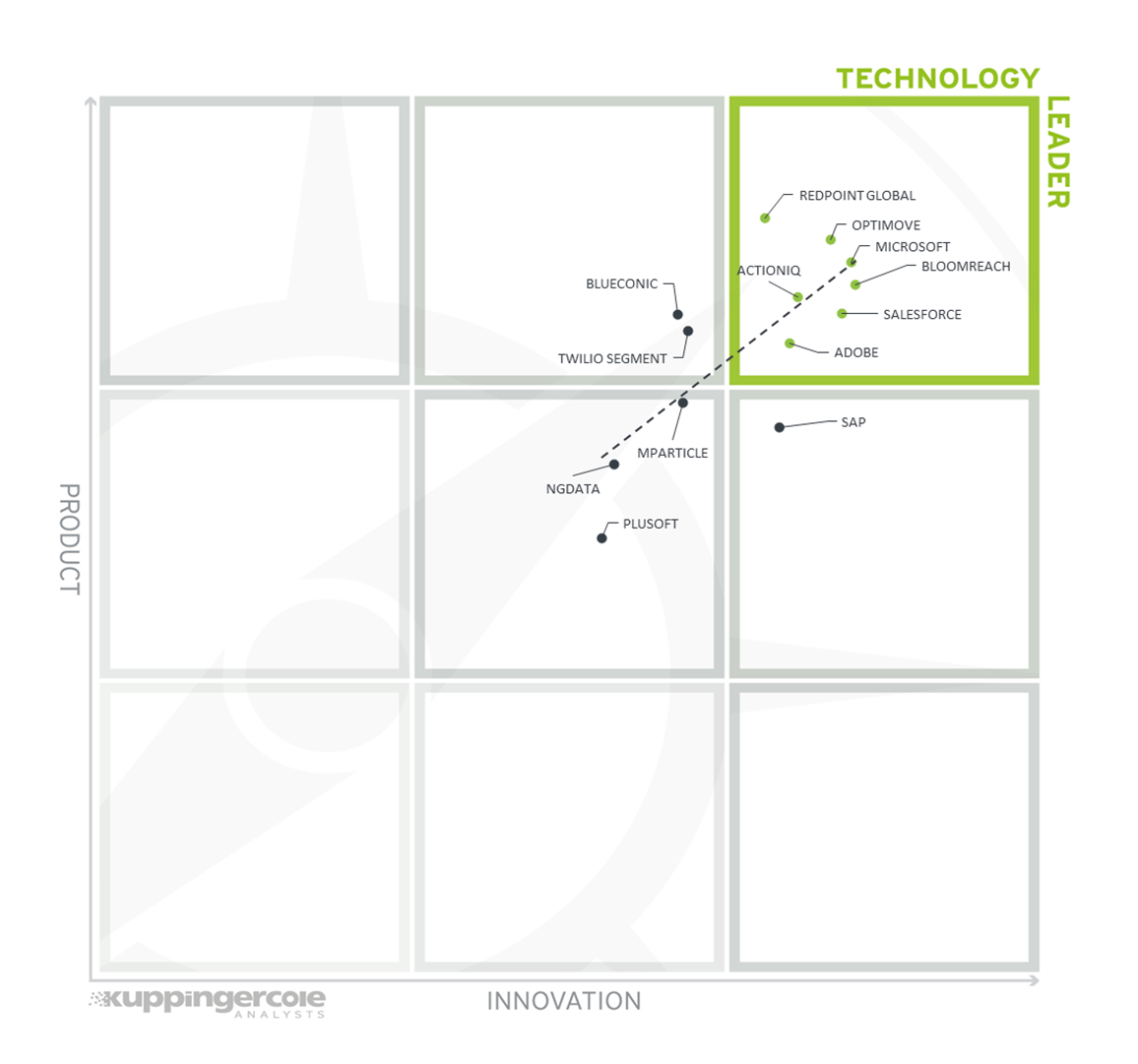

3.2 The Product/Innovation Matrix

This view shows how Product Leadership and Innovation Leadership are correlated.

Vendors below the line are more innovative; vendors above the line are (compared to the current Product Leadership positioning) less innovative.

It is not a surprise that the vendors in the upper right segment also score well in the overall rating. On the other hand, the diagram shows that there is no clear relationship between product and innovations. This means that there are vendors with strong products that are less innovative ― and vice versa.

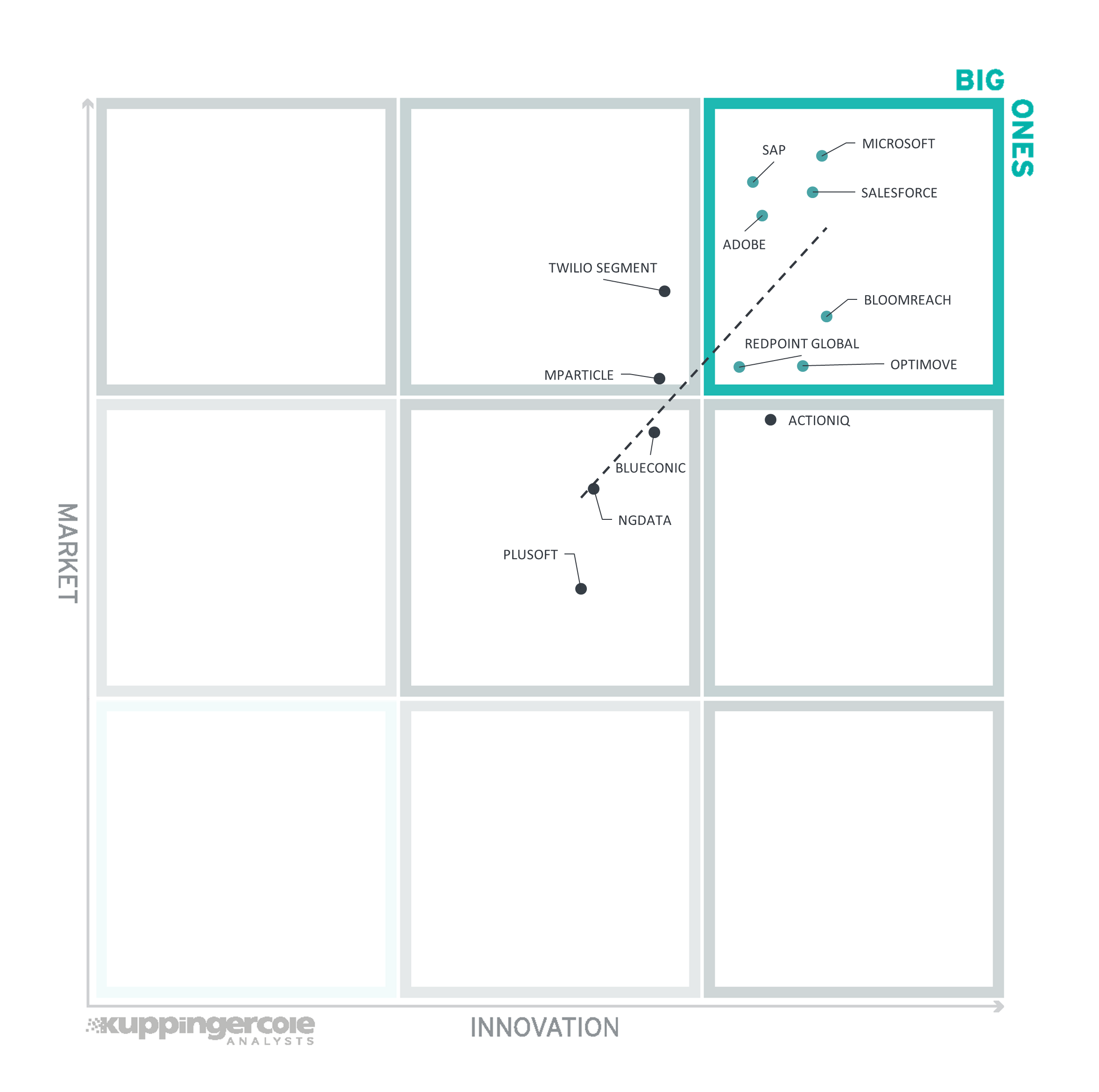

3.3 The Innovation/Market Matrix

The third matrix shows how Innovation Leadership and Market Leadership are related. Some vendors might perform well in the market without being Innovation Leaders. This might impose a risk for their future position in the market, depending on how they improve their Innovation Leadership position. On the other hand, vendors which are highly innovative have a good chance for improving their market position. However, there is always a possibility that they might also fail, especially in the case of smaller vendors.

Vendors above the line are performing well in the market as well as showing Innovation Leadership, while vendors below the line show an ability to innovate though having less market share, and thus have the biggest potential for improving their market position.

It is apparent that the correlation between Market Leadership and Innovation Leadership is quite low. One reason is that there are many smaller but highly innovative vendors in this relatively new market. These vendors will have the chance to gain market relevance based on their innovative products. This will lead to the probability that in a few years there will be a better correlation.

4 Products and Vendors at a Glance

This section provides an overview of the various products we have analyzed within this KuppingerCole Leadership Compass on Customer Data Platforms. Aside from the rating overview, we provide additional comparisons that put Product Leadership, Innovation Leadership, and Market Leadership in relation to each other. These allow identifying, for instance, highly innovative but specialized vendors or local players that provide strong product features but do not have a global presence and large customer base yet.

Based on our evaluation, a comparative overview of the ratings of all the products covered in this document is shown in Table 1.

| Product | Security | Functionality | Deployment | Interoperability | Usability |

|---|---|---|---|---|---|

| ActionIQ Customer Experience Hub |  |

|

|

|

|

| Adobe Real-Time CDP |  |

|

|

|

|

| Bloomreach Engagement |  |

|

|

|

|

| BlueConic |  |

|

|

|

|

| Microsoft Dynamics 365 Customer Insights |  |

|

|

|

|

| mParticle Customer Data Platform |  |

|

|

|

|

| NGDATA Intelligent Engagement Platform |  |

|

|

|

|

| Optimove |  |

|

|

|

|

| Plusoft |  |

|

|

|

|

| Redpoint Global rgOne |  |

|

|

|

|

| Salesforce Customer Data Platform |  |

|

|

|

|

| SAP Customer Data Platform (CDP) |  |

|

|

|

|

| Twilio Segment |  |

|

|

|

|

Table 1: Comparative overview of the ratings for the product capabilities

In addition, we provide in Table 2 an overview which also contains four additional ratings for the vendor, going beyond the product view provided in the previous section. While the rating for Financial Strength applies to the vendor, the other ratings apply to the product.

| Vendor | Innovativeness | Market Position | Financial Strength | Ecosystem |

|---|---|---|---|---|

| ActionIQ |  |

|

|

|

| Adobe |  |

|

|

|

| Bloomreach |  |

|

|

|

| BlueConic |  |

|

|

|

| Microsoft |  |

|

|

|

| mParticle |  |

|

|

|

| NGDATA |  |

|

|

|

| Optimove |  |

|

|

|

| Plusoft |  |

|

|

|

| Redpoint Global |  |

|

|

|

| Salesforce |  |

|

|

|

| SAP |  |

|

|

|

| Twilio |  |

|

|

|

Table 2: Comparative overview of the ratings for vendors

5 Product/Vendor evaluation

This section contains a quick rating for every product/service we've included in this KuppingerCole Leadership Compass document. For many of the products, there are additional KuppingerCole Product Reports and Executive Views available, providing more detailed information.

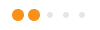

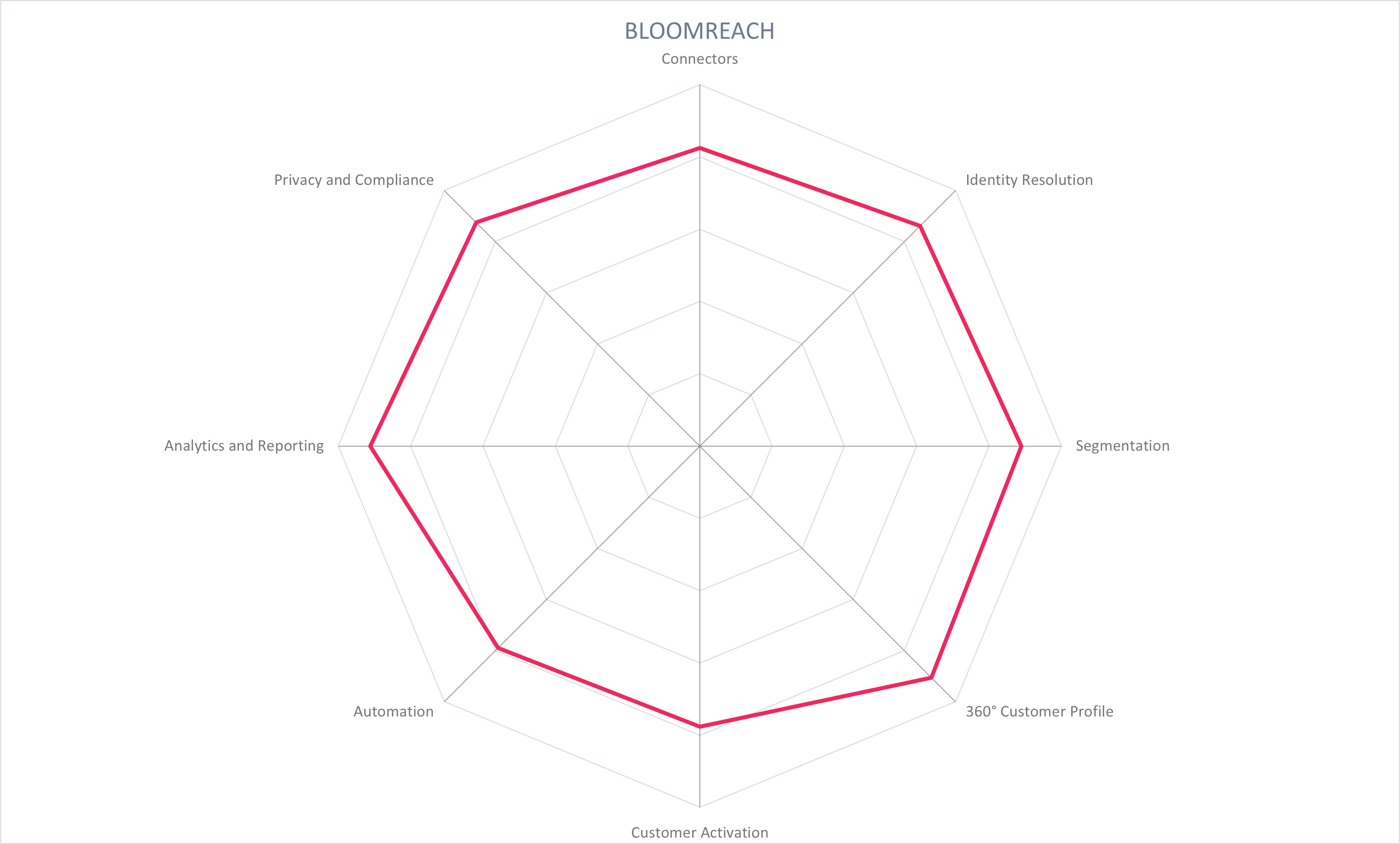

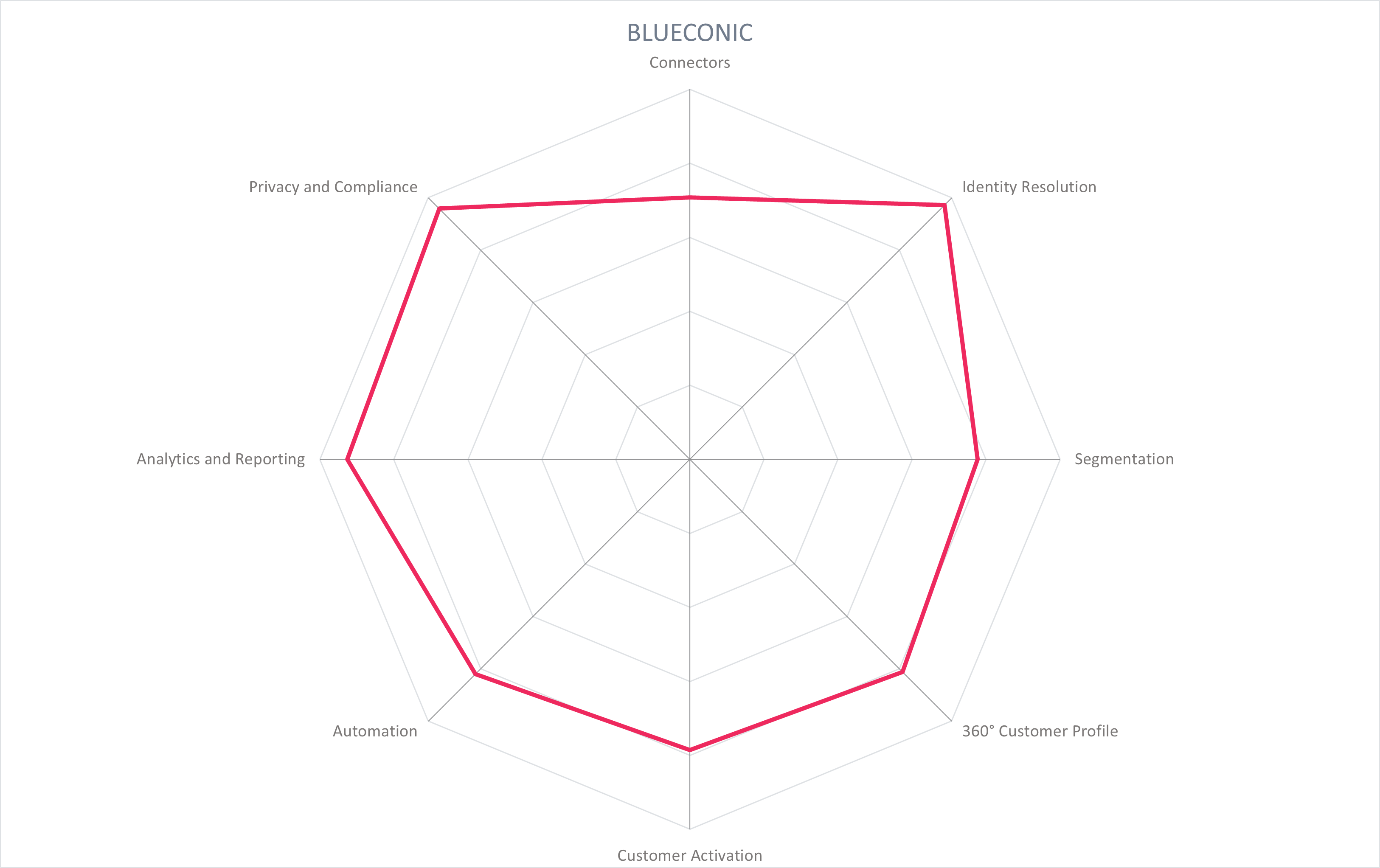

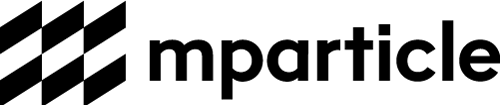

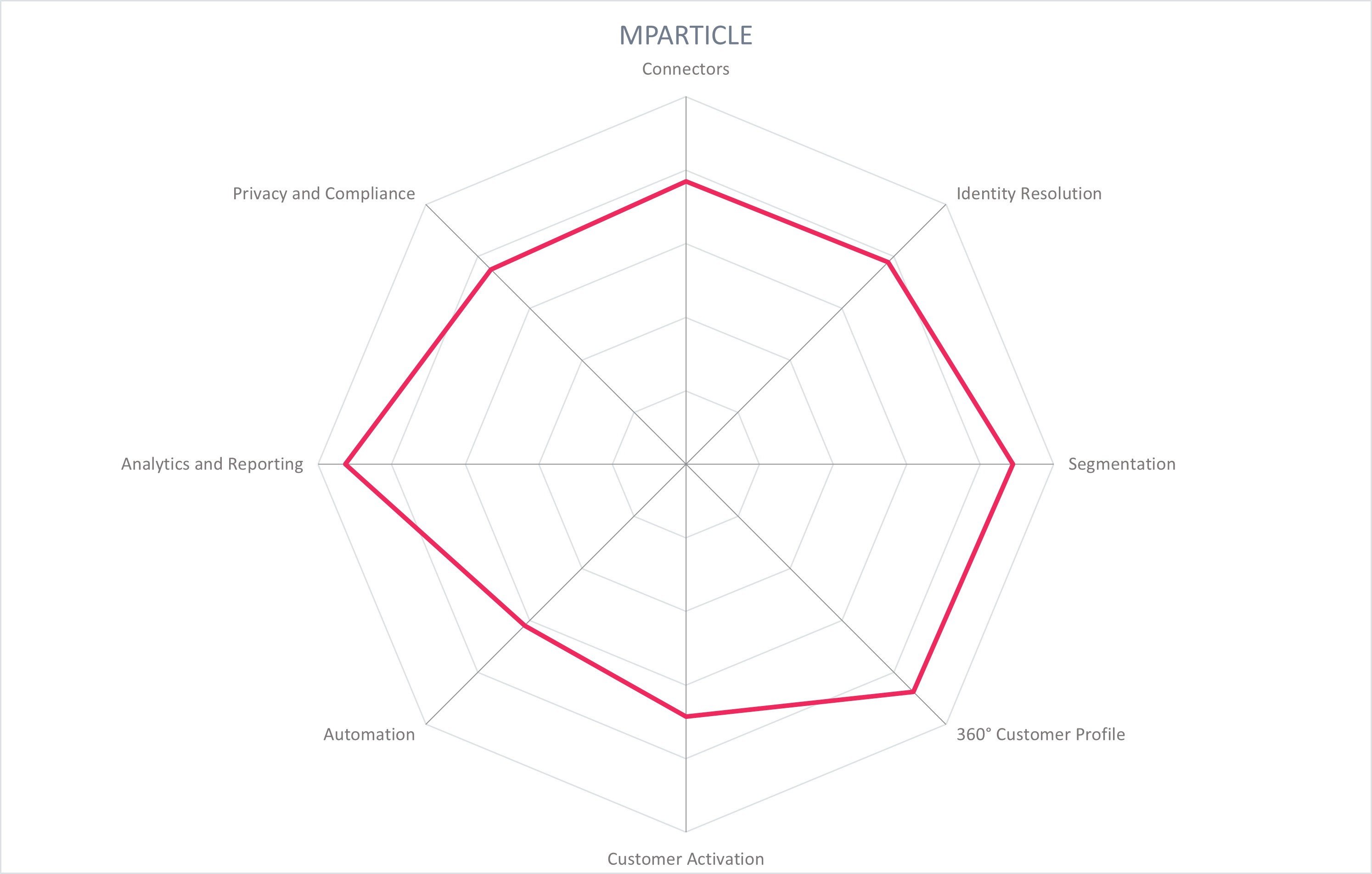

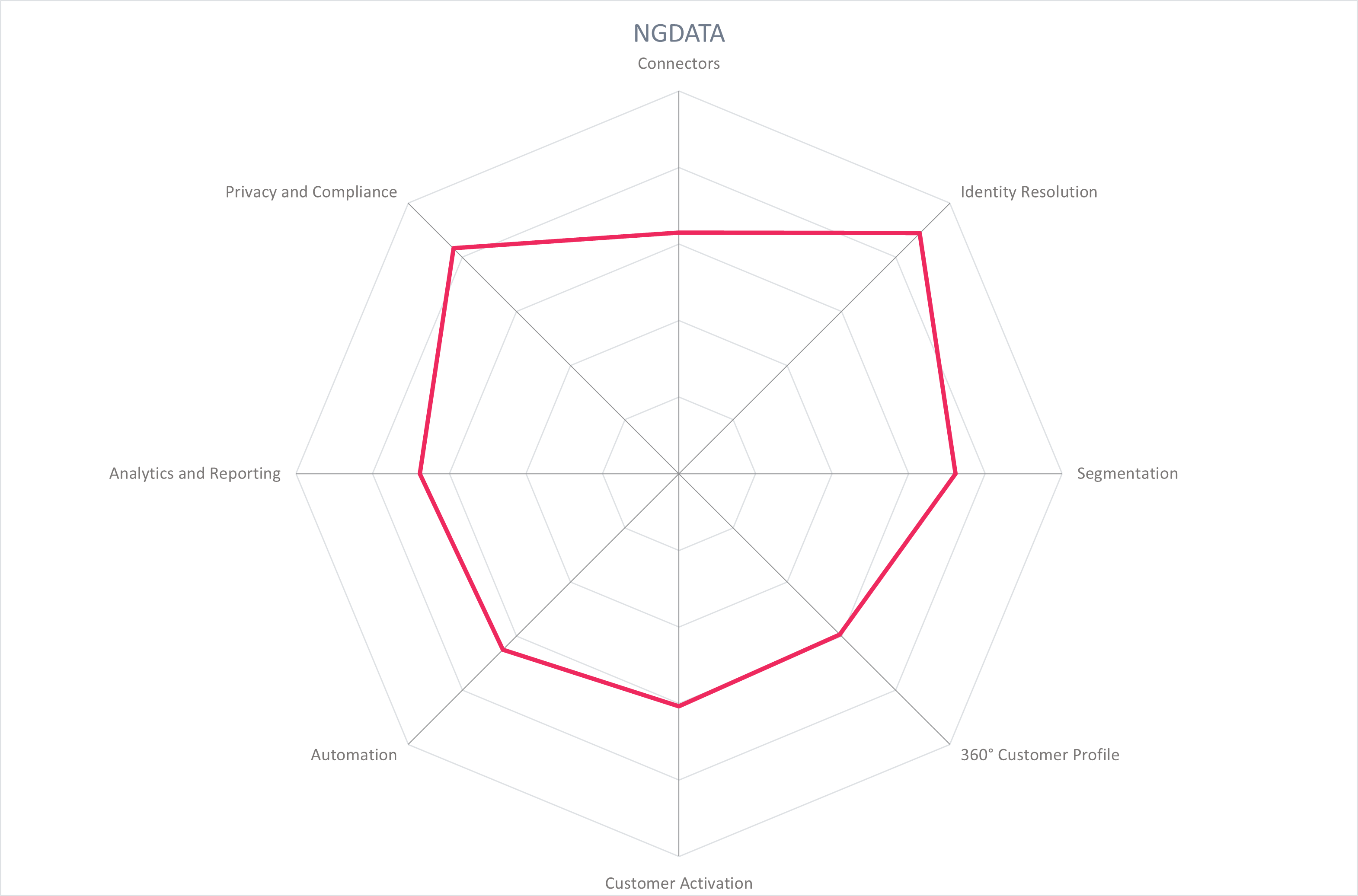

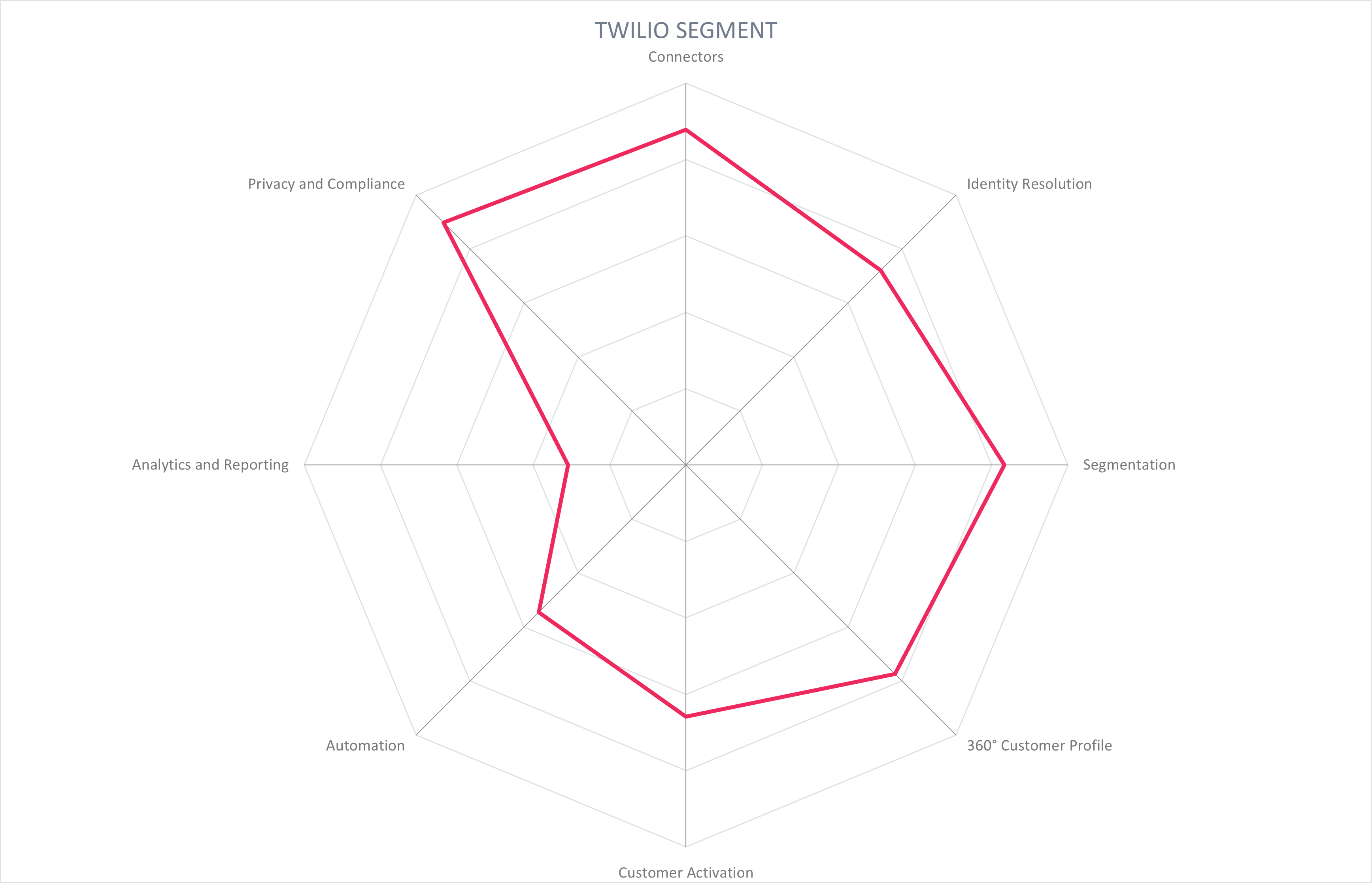

Spider graphs

In addition to the ratings for our standard categories such as Product Leadership and Innovation Leadership, we add spider charts for every vendor we rate, looking at specific capabilities for the market segment. For the Customer Data Platforms LC, we look at the following eight categories:

- Connectors

One of the key capabilities of a customer data platform is the availability of connectors to third-party systems. In our rating we consider the variety of connectors to relevant data sources and recipients. This includes the ingestion of bulk and transitional data. Furthermore, the way data can be transmitted to external third-party systems is a criterion. - Identity Resolution

An important capability of a customer data platform is identity resolution, based on unregistered and/or registered customers. Based on various indicators, such as first-party cookies or device IDs, a CDP must be able to recognize users and assign them to existing customer profiles as available. In general, there are two approaches when it comes to identity resolution: a deterministic approach is focused on "known" information, such as email address or phone number; a probabilistic approach resolves identities based on predictions (e.g., using statistical methods and/or machine learning). The ability to create household or company profiles is a further criterion. - Segmentation

For marketers, it is key to address appropriate marketing measures and personalized content to the right audience. Therefore, segmentation is an important criterion when it comes to using a customer data platform. Creation of customer segments based on various criteria is a basic functionality of a customer data platform. Creating such segments is handled in many different ways, often powered by smart automation based on machine learning. - 360-Degree Customer Profile

Customer data platforms help create a 360-degree customer profile based on various attributes that are gathered across multiple input channels. The considered information, how the data is structured, and the presentation when analyzing such customer profiles are relevant criteria. - Customer Activation

For organizations, it is key to activate customers based on the data that has been gathered in a customer data platform. This can be handled via connectors to external systems and touchpoints. Furthermore, many CDPs have the capability to manage and orchestrate customer journeys when it comes to personalized campaigns, recommendations, lead nurturing, next best actions, etc. We evaluate the capabilities to manage such customer activation activities in this category. - Automation

When it comes to the management of millions of customer profiles, automation is key. In this category, we evaluate all capabilities in terms of automation that can be accomplished in a CDP, such as automated segmentation, automated customer activation, automated reporting, or automation based on machine learning. - Analytics/Reporting

Customer data platforms manage highly interesting data to create insights based on analytics and reporting. In this section, we evaluate a CDP's capability and flexibility to create such analytics and reporting. The ability to consider insights based on analytics directly in the system (e.g., with an impact on segmentation or customer activation) is also considered. - Privacy and Compliance

As customer data platforms process personally identifiable information (PII), it is key that a system comply with relevant standards and legislation (e.g., GDPR). In this criteria, we evaluate technical capabilities to ensure privacy and compliance. We also consider certifications, such as ISO 27001, SOC 2 Type 2, etc.

5.1 ActionIQ - ActionIQ Customer Experience Hub

ActionIQ, founded in 2014, is a vendor that has a very strong focus on customer experience solutions in both B2C and B2B scenarios. Their product "ActionIQ Customer Experience Hub" comprises key capabilities in building 360° customer profiles, segmentation, and customer intelligence, as well as a strong focus on omnichannel customer experiences.

Customer Experience Hub is used by organizations in diverse industrial sectors that apply both B2C and B2B approaches.

The system is hosted on AWS (Amazon Web Services) as a SaaS solution and is therefore fit for scalability.

The solution is easy to use and is ideal for non-technical users (such as marketers). The intuitive graphical user interface is easy to understand and to manage all the functions without the need for a data analyst. In particular, the built-in connectors for a huge variety of third-party systems can be used in a highly intuitive "plug-and-play" manner. There is a clear and powerful focus on APIs and an easy integration with various solutions that play a role in the customer, sales, and marketing automation ecosystem.

The segmentation of customer audiences can be done in a very convenient way, using drag and drop functionality. Calculations, such as the audience size, and further analytics are made in real-time.

ActionIQ Customer Experience Hub has a strong focus on customer activation. It includes a highly intuitive and powerful customer orchestration tool that enables the creation of intelligent customer journey setups in a very smart way using the graphical user interface.

The various areas of the system are seamlessly integrated, including the customer profiles, segmentation, and customer journey orchestration. In comparison with many other solutions, it is clear that Customer Experience Hub has been designed with a strong focus on the customer experience: both the experience of the members of an organization that work with the solution and the customers of such organizations who will benefit from the enhanced customer experience facilitated by the Customer Experience Hub.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.2 Adobe - Real-Time CDP

Adobe is definitely one of the big players in the marketing world, and most marketeers probably already use or are familiar with some Adobe products for content and media creation.

Adobe's CDP solution, "Adobe Real-Time CDP", is perfectly integrated in the Adobe ecosystem, which is useful for organizations that already use a Adobe technology stack. Though even for other organizations, Adobe's CDP solution may be a good fit.

The application is part of Adobe's comprehensive "Experience Cloud", which consists of approximately 10 applications in the following categories: "Content & Commerce", "Data Insights and Audiences", "Customer Journeys" and "Marketing Workflows". Real-Time CDP belongs to the category "Data Insights and Audiences".

Adobe's CDP offering is a PaaS offering that CDP clients can use. It is hosted on Azure.

The solution is a good fit for both B2C and B2B scenarios, as proven by its many customers in organizations in various industrial sectors around the world.

The solution has a graphical user interface that is easy to use, even for non-technical users. Furthermore, as mentioned above, many organizations and marketers might be already familiar with Adobe's look and feel through their other products.

This solution offers a comprehensive and powerful feature set covering all the relevant topics for the management of customer profiles, including data ingestion, cleansing, and enrichment, identity resolution, segmentation, customer activation, and analytics/reporting. The system capabilities are supported by machine learning to deliver customized and real-time customer experiences.

Many connectors are available as "plug-and-play" solutions, which should enable non-technical users to also be able to set up connections to third-party systems.

The inclusion of a highly intuitive customer journey builder makes it easy to manage touchpoints in and outside Adobe's technology stack. Furthermore, a highlight of Adobe's customer journey builder is a graphical tool to analyze the customer journey performance.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.3 Bloomreach - Bloomreach Engagement

Bloomreach was founded in 2009. Their CDP solution "Bloomreach Engagement" is a powerful platform. Customers can seamlessly add other Bloomreach modules, such as Bloomreach Discovery (search and merchandising for commerce companies) and Bloomreach Content (headless CMS for commerce companies), which are all part of an extensive ecosystem with a strong focus on the customer experience.

Bloomreach has customers all over the world and supports many well-known brands in diverse industrial sectors with its solutions. It has a strong focus on B2C business cases.

The solution is deployed as a cloud-based SaaS, and it is highly flexible and adaptable when it comes to scaling. Furthermore, clients can choose to use their existing cloud infrastructure if desired (based on Google Cloud Platform).

Bloomreach Engagement has a strong focus on ensuring an easy-to-use platform with its no-code/low-code environment. All areas of the solution can be managed via a highly intuitive graphical user interface that is ideal for non-technical users, such as marketers.

In terms of functionality, the solution covers all aspects that we consider as relevant for a CDP and it is presented in a highly intuitive way. Connectors to many third-party solutions are available for data ingest or export. Strong capabilities in terms of identity resolution, 360° customer profiling, and segmentation are present and are very well integrated with other solutions in the Bloomreach ecosystem and further with third-party solutions. In particular, the smart interaction between customer profiles and automated segmentation is a highlight of the solution.

The solution provides strong capabilities for identity resolution in B2C scenarios (e.g., when it comes to household profiles). Given this B2C orientation, the focus is not on resolving company profiles.

Bloomreach Engagement provides all the necessary capabilities for marketing automation and activates data from the CDP seamlessly so that there is no need for further integration with other products as mentioned above or similar - nevertheless, third-party solutions can be connected if needed.

Dashboard and reports can be created in a highly flexible and intuitive way.

Furthermore, many actions can be supported by machine learning. The solution contains no-code functionality to allow the facile creation of machine learning models or the modification of prebuilt models.

A strong roadmap is outlined, with evolution in all areas of the Bloomreach ecosystem.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.4 BlueConic - BlueConic

BlueConic, founded in 2010, offers a standalone Customer Data Platform. The company is strongly focused on the CDP market. Customers from various industrial sectors use the platform for B2C and B2B use cases, as it supports both household- and company-based profiling. Many organizations in the media and consumer goods sector use BlueConic's solution. In total, more that 500 million profiles are managed by BlueConic's solutions.

The system is available as a SaaS model based on AWS (Amazon Web Services); therefore, highly flexible scalability is possible.

The solution is a standalone platform. It includes native consent management, identity resolution, unified profiles, segmentation, modeling and analytics, and lifecycle orchestration. It is agnostic about the data sources or types, and about which systems the data needs to be routed to. CDP features are all standard and included by BlueConic. Additional data configurations and products, such as an aggregated data manager and data clean rooms, are offered as add-ons.

The solution allows flexible data input and output. Connections to third-party systems can be managed even by non-technical users.

A highly intuitive 360° Customer View is available based on an easy-to-use graphical user interface that can be managed by growth-focused users including marketing and CX teams. Furthermore, multi-dimensional segmentation is possible based on any profile attributes including customer scores, behavioral attributes, consent, and more.

Strong decisioning and analytics capabilities are a key strength of this solution. BlueConic makes it easy for marketers to analyze the customer journey and customer behavior across the customer lifecycle from "awareness" to "retention". Based on the interactive graphical interface, marketers can easily analyze the behavior of anonymous and known users along the whole customer journey. This is a very good basis to continuously optimize touchpoints.

An "AI Workbench" is included that offers access to various machine learning models - so-called Notebooks. These offer a set of prebuilt machine learning models for various purposes, such as probabilistic identity matching, next-best actions, and A/B testing. From the graphical user interface, the creation and manipulation of machine learning models is possible without a need for coding.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.5 Microsoft - Microsoft Dynamics 365 Customer Insights

Microsoft, one of the biggest players in this sector, offers "Microsoft Dynamics 365 Customer Insights", a customer data platform that is part of the extensive Microsoft ecosystem, which consists of Dynamics 365, Azure, and many other components.

Microsoft's solution is used by a huge variety of organizations in all industrial sectors, in both the B2C and B2B worlds - often in combination with other components of the Microsoft ecosystem, such as Microsoft customer relationship management solutions, also based on Dynamics 365. Nevertheless, connectors and interfaces to a huge set of third-party solutions are available for data ingest and export.

The solution is available as a SaaS cloud service and is based on Microsoft Azure, and therefore is ready for scaling as needed.

Microsoft Dynamics 365 Customer Insights comprises all elements of a CDP platform to enable profile building based on flexible data ingestion and identity resolution, with a full 360° customer profile view. Furthermore, the solution offers a great toolset when it comes to customer activation and customer journey automation based on Microsoft Dynamics 365 Marketing. This includes graphical interfaces that enable customer journey orchestration considering various touchpoints.

In terms of data management, the integration with other solutions in the Microsoft ecosystem (e.g., Power BI) offers powerful possibilities to analyze, cleanse, and enrich data. Also, very flexible reporting is possible.

All actions can be performed using the intuitive graphical user interface, even by non-technical users. Nevertheless, Microsoft also offers the possibilities for technical users (such as data analysts) to use code and custom measures and machine learning models. In addition, templates and prebuilt machine learning models can be used.

The integration of Azure AI enables machine learning related to many activities, such as recommendation management,next-best actions, or discovery of customer segments. The creation or modification of machine learning can be done either based on the GUI or on code. Furthermore, third-party machine learning frameworks and technologies can be used, such as Google TensorFlow.

The solution has strong capabilities in terms of privacy and compliance, and a huge set of certifications has already been achieved.

The roadmap is ambitious, and the product vision is clear, and are closely linked to overarching activities in the Microsoft ecosystem.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.6 mParticle - mParticle Customer Data Platform

mParticle, founded in 2013, offers with its Customer Data Platform a solution that is used by diverse organizations across various industrial sectors in both B2B and B2C scenarios, such as e-commerce, multichannel retail, media, and food production.

The core product includes various capabilities, such as a connectivity platform, data quality management, data governance (privacy controls), audience and journey builder, calculated attributes, and analytics.

The system is available as a SaaS model based on AWS (Amazon Web Services), and therefore offers very flexible scalability.

It is very easy to set up new connections to third-party systems based on the graphical user interface.

Compared to many other solutions that consider both deterministic and probabilistic identity resolution, mParticle takes a fully deterministic approach. For every data point that comes into the platform, it ties it back to a unique user who is always associated with a persistent identifier.

The system includes comprehensive analytics and reporting capabilities, including configurable dashboards that make it easy for marketers or other non-technical users to analyze customer behavior and interactions. The whole sales funnel can be examined like this, in order to detect successful and weak touchpoints within a customer journey. This includes results based on A/B testing as well.

mParticle has a strong focus on real-time interactions with very short latency, which might be a plus for many customer experience cases. A focus on mobile customer experiences is also worth mentioning.

A customer journey builder has been newly released by mParticle. It has interesting capabilities to manage customer activation measures and orchestrate customer journeys.

The embedded privacy control of mParticle's solution is one highlight that makes it easy for marketers to comply with existing privacy regulation and legislation. Filters allow easily configuring the data transfer from or to external systems - to minimize data needs and to ensure privacy or to consider customer consent.

Although it is on the roadmap, mParticle's solution does not comprise its own machine learning capabilities right now. Furthermore, in keeping with a best-in-breed philosophy, they partner with third-party providers (e.g., AWS) and provide deep integrations (e.g., Kinesis) to leverage their state-of-the-art machine learning capabilities.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.7 NGDATA - Intelligent Engagement Platform

NGDATA, headquartered in Belgium and globally active, was founded in 2012. Their CDP solution "Intelligent Engagement Platform" is used by various customers in different branches and industrial sectors, but their main focus is on the banking and insurance sectors.

The solution offers all the key capabilities of a customer data platform and is a good fit for typical best-of-breed scenarios.

The deployment models of NGDATA are very flexible. In contrast to many other vendors, NGDATA offers installation at a customer's premises as well as the option for setup as cloud services or managed services. A multi-tenant cloud is also available for partners and customers.

Intelligent Engagement Platform offers a graphical user interface that is suitable for marketers or any other non-technical users. It is easily possible to import batch or real-time data to form a 360° customer profile.

It offers many connectors to third-party systems for flexible data input and output, combined with strong segmentation capabilities and a strong focus on real-time interactions with customers.

NGDATA has strong features when it comes to identity resolution, considering both known and anonymous users/customers. Furthermore, it can deal with both household- and company-based users, which makes the system fit-for-purpose for various B2C and B2B scenarios.

The solution has a set of powerful capabilities when it comes to privacy requirements, which might be driven by their focus on the banking and insurance sectors. This is a clear USP of NGDATA's solution compared to other vendors.

Furthermore, several report and analytics capabilities enable marketers to analyze their customer behavior.

The NGDATA IEP provides both a fully automated and a manual way to configure and run predictive models. Data scientists have the option to manually configure and run predictive models using python in an integrated way.

NGDATA has developed an innovative roadmap: A GUI-based customer journey and a dashboarding feature are two worth mentioning on the roadmap.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

5.8 Optimove - Optimove

Optimove, founded in 2009, is a single product vendor that is focused only on its CDP platform. The company has customers across various industrial sectors.

The solution is a typical standalone CDP with extensive functionality to support its integration in a best-of-breed technology stack.

Optimove is available as a SaaS solution that is hosted in the cloud, which is a good basis for scalability.

The solution contains all relevant features that are typical for a CDP solution, made in a very smart and intuitive way - starting from data ingestion to profile building, identity resolution, and segmentation. The solution delivers very good capabilities when it comes to real-time customer experience scenarios.

All the features harmonize and communicate with each other in an outstanding way. This makes it easy for marketers or other users to continuously optimize the customer experience based on insights gained and through automation.

Optimove supports the clustering of records under "parent accounts", which can be used to unify the records of different family members under a single family. Alternatively, this method can be used to handle company profiles as well. This makes the solution fit for purpose when it comes to B2C or B2B scenarios.

Segmentation functionalities are highly flexible and automated. This enables the very powerful management of segments as needed to reach out to customers in a highly personalized way.

A very intuitive customer journey builder is not just an add-on but is seamlessly integrated with the other functionalities of the solution, and is easy to use, based on a graphical user interface.

An extensive analysis and reporting area called "Mission Control" gives important insights to marketers based on various criteria. Optimove has created an outstanding way to adapt and optimize segmentation or the customer experiences directly based on insights - a clear USP of the solution.

Integrated machine learning is part of the solution and is supported across the whole feature set.

Optimove has an ambitious roadmap: a optimized mobile SDK, and additional self-serve functionality to empower marketers in terms of setting up configurations without the help of data analysts.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.9 Plusoft - DTM / Omni CRM

Plusoft, located in Brasil, and founded in 1988, is a well-established and known vendor in South America.

Plusoft offers a set of solutions that are focused on customer relationship management, marketing automation, and learning platforms. All solutions are powered by a centralized AI framework.

In this leadership compass, we evaluated a combination of two solutions from Plusoft: Omni CRM and DTM.

Omni CRM is focused on all the capabilities of a classical CRM system, including the functionality of the customer data platform. Customer profiles can be maintained, based on data input from various sources. The solution comprises analytics and reports to gather insights based on various parameters.

In addition, DTM brings further functionality when it comes to customer journey orchestration, managing various touchpoints, and channels. Customer journeys can be set up considering various touchpoints in the Plusoft ecosystem or based on connected third-party solutions.

Together, these solutions comprise capabilities that are related to customer data platforms, although the approach is slightly different compared to most other solutions considered in this report. This means that topics such as identity resolution and segmentation are not done in the same way that most other "classical" CDP systems handle these topics.

The focus of Plusoft is rather on a comprehensive overall marketing solution and is not just related to CDP. This makes Plusoft's offering attractive for organizations that need an integrated CRM and marketing automation solution with CDP capabilities, but not with the focus on a "pure" CDP.

In addition, Plusoft offers good solutions in terms of social media marketing and a comprehensive learning platform.

Being more than just a software company, Plusoft even offers marketing services as a "full-service package" to its customers. This might be a compelling alternative compared to the other vendors considered in this report.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

5.10 Redpoint Global - rgOne

Redpoint Global, founded in 2006, offers with its solution rgOne a comprehensive platform that is used by customers in various industrial sectors around the world. This platform is focused on customer data management, machine learning, and the intelligent orchestration of customer journeys across all channels. It consists of various parts that can be clustered into three main categories: data, insights, and actions.

Redpoint Global's deployment models are highly flexible. In contrast to many other vendors, rgOne can be installed at the customer's premises as well as provisioned as cloud services or managed services.

The solution covers all aspects considered relevant for a customer data platform. With huge set of connectors and interfaces, strong capabilities in terms of 360° customer profiles, identity resolution (based on deterministic and AI-based probabilistic matching), and segmentation, the solution is highly flexible to adapt to individual scenarios.

RgOne is a fit-for-purpose platform for both B2B and B2C scenarios: it supports profiles and identity resolution for different entity types (e.g., "individual", "household", "address", and "organization" can each be an entity type with separate rules).

A highly intuitive customer journey orchestration tool and automation capabilities ensure the system has strong capabilities to manage customer activation, which is a clear focus of this solution in addition to the above-mentioned functionalities.

All features are accessible through an intuitive graphical user interface, which is easy to use by non-technical users as well as more technical users.

The solution utilizes machine learning capabilities that empower both the data management and customer journey orchestration functionality. This also comprises no-code machine learning model creation or use/modification based on a set of prebuilt models.

Furthermore, the solution complies with all relevant privacy regulations and offers comprehensive capabilities for privacy topics when processing personal identifiable information in their solution.

Redpoint Global has an interesting roadmap, with topics, such as a healthcare focus and IoT expansion, included.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.11 Salesforce - Customer Data Platform

Salesforce is one of the most well-known and biggest players when it comes to customer focused solutions, such as CRM. In this context, Salesforce offers a customer data platform (called Marketing Cloud Customer Data Platform) as part of its extensive ecosystem.

As a global player, Salesforce supports customers worldwide with its solutions, considering all industrial sectors in B2C and B2B.

The solution may be most suitable for organizations that already use solutions from Salesforce, although Salesforce's customer data platform fits a best-of-breed approach as well, as it offers flexible connectors and interfaces to a huge variety of third-party solutions. In this report, we focused on the Salesforce customer data platform, but nevertheless, Salesforce's overall ecosystem needs to be considered as well.

The solution fully hosts a SaaS, cloud-based platform, that can be fitted to scale based on an organization's needs.

All expected capabilities are fulfilled by the solution, from data ingestion, identity resolution, creation of 360° customer profiles to customer activation topics and extensive reporting and analytics capabilities. The solution consists of a huge set of connectors and interfaces to various data sources and data recipients.

In terms of segmentation and many other user cases, the solution is empowered by Salesforce's proprietary machine learning solution "Einstein".

An intuitive, graphical interface makes the solution fit for usage by non-technical users.

In terms of privacy topics, the solution complies with all relevant standards and legislation.

It is probably not a secret as many organizations around the globe already use Salesforce's CRM but adding a customer data platform based on the same ecosystem might be an obvious next step to ensure a seamless customer experience.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.12 SAP - SAP Customer Data Platform (CDP)

SAP is known as a global leader in ERP solutions along with Supply Chain, HXM, Financial Management and Customer Experience. SAP also offers a customer data platform as part of their ecosystem. This differentiates SAP in that its roots are not in the domain of marketing or customer relationship solutions like many other vendors that offer CDPs. Also, the key message beyond this fact is that a CDP is much more than a marketing or customer platform, it is a holistic platform that touches and delivers value to all areas of an organization.

As a global and well-established big player, SAP has customers all over the world in various industrial sectors, although the CDP solution is focused on both B2C and B2B customer scenarios.

The solution is deployed as a SaaS model, which can be scaled in a flexible way.

SAP's Customer Data Platform covers all relevant features from data ingestion, to building 360° customer profiles, and segmentation. Furthermore, analytics and reporting capabilities are part of the solution.

Machine learning is an integrated part of the solution and supports many of the above-listed features.

A clear USP of the solution is the ERP-focused ecosystem. While most other CDP solution are mainly designed to interact with marketing and customer focused first- and third-party solutions, SAP's approach is different as it has a strong focus on ERP-based data. This means that SAP's CDP might be an good choice when it comes to customer profiling and customer interaction driven by such data.

When it comes to privacy and compliance with relevant standards and legislation, the solution performs very well and is a good choice to process personal identifiable information in a secure and reliable way. It has a seamless integration with its leading CIAM solution, Gigya acquisition 2017, to provide an identity and consent first framework as part of a customer centric strategy.

In addition, SAP has a very ambitious roadmap for the solution with a very strong focus on B2B-oriented use cases. Furthermore, among other features, an AI/ML workbench enables users to create machine learning models based on a no-code configurator.

In conclusion, SAP is relatively new to the CDP segment (compared to its activities in the ERP sector). The focus and roadmap for the solution might make it a good fit for all organizations that consider CDP as a topic that is much more than only marketing.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.13 Twilio - Twilio Segment

Twilio, headquartered in California, acquired the well-known customer data platform Segment in 2020. Twilio has a focus on building industry-leading communication APIs (SMS, Voice, Video, and Authentication) that allow businesses to better engage with their customers. It's these features coupled with a CDP that makes Twilio's offering a complete package. The CDP is offered as a stand-alone platform; however, depending on use cases, additional Twilio services can be purchased to increase functionality.

Twilio is a big and global player. Segment is currently used by more than 20,000 customers of various industrial sectors around the globe.

Twilio Segment can be deployed as a scalable, multi-tenant cloud solution. It offers flexible storage options for customer data based on an organization's needs. Based on it's standard offering, Twilio manages the data storage. In addition, it allows customers to replicate their data in a data warehouse or data lake, considering flexible solutions for regulatory compliance, such as with the GDPR.

The solution comprises smart features related to identity resolution, data quality, segmentation, and building customer profiles. Furthermore, the solution has an intuitive customer journey builder that orchestrates a huge variety of customer touchpoints (mainly based on connectors to a third-party system ― or within the Twilio ecosystem).

Twilio Segment is focused on the core capabilities of a CDP within a best-of-breed environment. Based on a huge set of more than 400 connectors and interfaces, Twilio can be used in a very flexible way and easily connected to an existing technology stack in an organization. This is one of the main differentiators of Twilio Segment.

Furthermore, Twilio is made for marketers, product teams and data engineers (or other technical users). It offers graphical user interfaces that are easy to use by marketers. But it also allows more advanced options for technical users who might prefer to use code to manage advanced functionalities or customization.

When it comes to extended functionality, such as reporting, analytics, customer activation, or machine learning, Twilio Segment focuses on its flexible best-of-breed concept with connectors to market leading analytics, activation and machine learning tools.

Twilio Segment is a strong player when it comes to security and privacy topics providing a GDPR compliant solution and locally hosted instances in the European Union. Furthermore, it offers a great support structure.

Twilio Segment is different from many other solutions presented in this leadership compass, as it really focuses on the core capabilities of a data CDP in a smart and outstanding way. This might be a great fit for many organizations with a strong focus on data quality and best-of-breed approach.

The road map is highly interesting, with a focus on personalized campaign management (Twilio Engage) that can be used on top of the CDP. In addition, further integrations, regional instances, and additional features and optimizations are part of the road map.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

6 Vendors to Watch

Besides the vendors covered in detail in this document, we observe some other vendors in the market that readers should be aware of. These vendors do not fully fit the market definition but offer a significant contribution to the market space. This may be for their supportive capabilities to the solutions reviewed in this document, for their unique methods of addressing the challenges of this segment or may be a fast-growing startup that may be a strong competitor in the future.

-

6sense - is a US-headquartered company that provides a CDP as a part of a platform that addresses marketing and sales processes for customer activation and the customer experience

Why worth watching - 6sense brings an innovative approach that sees CDP as part of the whole sales funnel.

-

Acquia - is headquartered in Boston, US. The company offers a comprehensive range of products that are related to marketing purposes, including content management, product information management, and customer data management. Furthermore, Aquia is very much focused on Drupal-based products.

Why worth watching - Acquia offers a quite complete product mix that can be used by organizations to empower their marketing and sales. In particular, the fact that a product information management system and a customer data platform are offered by the same vendor could be useful for many organizations.

-

Algonomy - has a strong focus on customer data platforms, customer analytics, omnichannel personalization, merchandizing, the supply chain, and customer journey orchestration. This global company is headquartered in the US.

Why worth watching - An innovative product range that includes a CDP might be a fit-for-purpose choice for retail-focused organizations and many other use cases.

-

Amperty - offers a DSP solution with a comprehensive feature set. In addition, a preconfigured package that seamlessly connects to Adobe tools is offered by Amperty.

Why worth watching - Apart from the core capabilities of its CDP solution, Amperty's solutions might be complelling for organizations that rely on an Adobe technology stack due to the seamless connection capabilities.

-

Blueshift - headquartered in the US, this company offers a flexible CDP solution in combination with other systems mainly related to automation and personalization. They have interesting customers and present case studies from around the world.

Why worth watching - Complete product range of CDP and customer activation focused solutions.

-

Caplillary Technologies - offers an Comprehensive product range, comprising solutions in the area of CDP, customer activation, marketing automation, and e-commerce. The company was founded in 2021.

Why worth watching - The solutions from Caplillary Technologies might be a good fit for organizations that are interested in a marketing and e-commerce technology stack from one vendor that offers a CDP as well.

-

Conscia - is a vendor that offers solutions with a focus on omnichannel management, data and API orchestration, customer data management, and content and product information management. The company is headquartered in Toronto, Canada.

Why worth watching - An innovative set of solutions with a focus on omnichannel, and content and product management in combination with CDP capabilities and an API-first approach that might be suitable for many organizations.

-