1 Introduction

SAP, the world’s 3rd largest software company headquartered in Germany, entered the cloud computing space 5 years ago and has quickly grown to offer numerous SaaS solutions. Accordingly, SAP has developed its own identity platform so that customers may integrate with their services: SAP HANA Cloud Platform Identity Authentication and SAP HANA Cloud Platform Identity Provisioning.

SAP Fraud Management, an element of SAP’s core GRC products, leverages the power and speed of the SAP HANA platform to detect fraud earlier, improve the accuracy of detection and uses predictive analytics to adapt to changes in fraud patterns.

It is estimated that a typical organisation loses 5% of its revenues to fraud and that globally it is a US$3.5 trillion-dollar problem[^1]

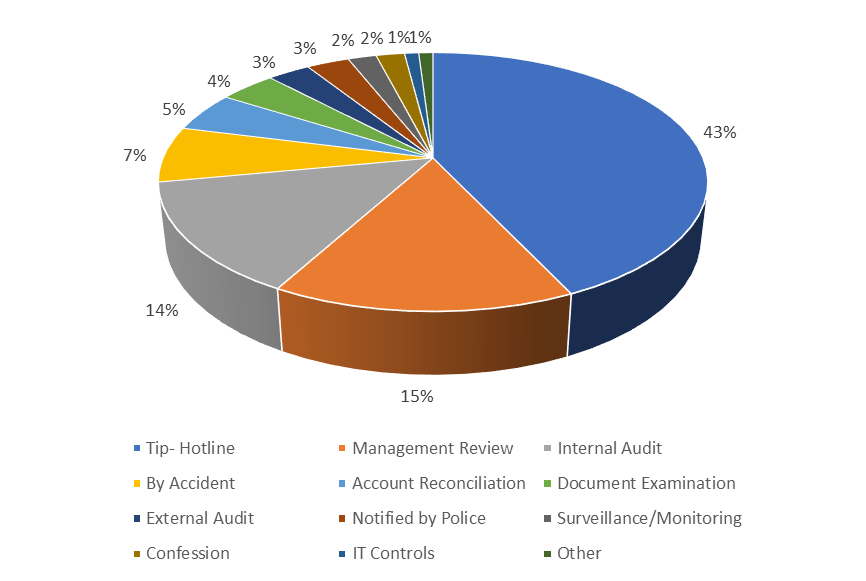

As can be seen from the above chart, fraud is typically detected without technology. Fraud costs public and private enterprises hundreds of billions of dollars each year, there is an exponential increase in the frequency and sophistication of fraud, there are diverse, complex and constantly changing fraud schemes and strategies, there is a huge volume of data from multiple sources to be interrogated and the fraud detection processes are hindered by operational and organisational silos.

Some 43% of fraud cases are detected by accident, after loss has already occurred. For effective fraud management, an organisation needs an approach that detects and prevents fraud – as it happens. The right solution will help your organization keep pace with ever-changing, increasingly sophisticated criminal tactics. Then, if fraud is suspected, the organisation’s analysts can investigate it efficiently and thoroughly check transactions without negatively impacting operational productivity.

As regulatory pressure grows, for example, to implement antibribery and anticorruption programs, the organisation also needs to detect and investigate various types of suspicious transactions to achieve compliance and protect the company’s reputation.

A solution to help you with these challenges is the SAP Fraud Management analytic application which is powered by the SAP HANA platform. This holistic solution can give your organisation the insight and speed needed to detect, prevent, and help deter fraud.