For anyone trying to keep up with “crypto” trends, good luck. Very often, articles and news around “crypto” lumps together everything that is futuristic about currency, investments and payments. As usual, the hype around new or trending concept leads to an overgeneralization of what that concept actually means. Organizations do need to decide what “crypto” means for their business, but they should be on their guard so as not to fall prey to a blind “crypto” craze. There is influence, risk, and legitimate business models to be found in the term “crypto”, but the first challenge is to understand it.

“Crypto” is a Misrepresentative Term

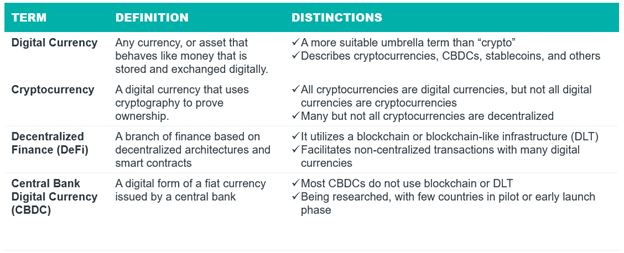

It’s first necessary to understand that “crypto” is a term that shouldn’t really be used to describe futuristic digital payments and currency systems. Its evolution is likely a short one, from cryptocurrency to cryptography. Cryptography, described at its simplest, is the mathematics of converting information into secrets. Cryptographic methods are used in some of the things that “crypto” tries to include: decentralized finance (DeFi), distributed ledger technology (DLT), cryptocurrencies (crypto), blockchain, Bitcoin, central bank digital currency (CBDC), and so on. Overall, “crypto” is an unsuccessful umbrella term for very different technological developments with very different risks, opportunities, and trajectories. A more suitable umbrella term for these terms could be Digital Currency, which has a wide enough definition to include the varying methods like cryptocurrency and stablecoins. The figure below lists a few of the terms most often lumped together under “crypto”, offers a very brief definition, and some of their distinctive features.

Figure 1: Terms Often Misrepresented by “Crypto”

Questions to Ask About Cryptocurrency

It’s worth it to keep these terms separate, but with an open eye for overarching trends. Cryptocurrency, for example, has plenty of people on edge. Cryptocurrency is intertwined with digital crime, ransomware being among the largest threats. Chainanalysis estimated that there was $14 billion worth of cryptocurrency lost to criminals in 2021, primarily from ransomware attacks, scams, and darkweb transactions. Concern is valid, as this is a 79% increase over 2020. But cryptocurrency should not just be a looming threat and risk to business, especially given that the overall volume of cryptocurrency transactions increased far more than criminal transactions did: Chainanalysis also estimates that legitimate cryptocurrency transactions reached $15 trillion in 2021, which is a 567% increase over 2020. Legitimate use of cryptocurrency is outpacing criminal use, and if cryptocurrency can ever get out of the speculative market there are strong opportunities for business.

These strong opportunities for business must be framed carefully. Cryptocurrencies in and of themselves don’t bring value to the business, but they can help to deliver business value. Their strengths lie in harnessing smart contracts to trigger payments only when certain required actions have been completed. Businesses should pay close attention to the ways that cryptocurrencies are stabilized to reduce their volatility. When this is achieved, the regulatory environment will be pressured to move quickly on issuing standards. The quickly evolving decentralized identity space will also play a role here, namely in enabling reusable, verifiable identities for transacting parties. Pairing verifiable identities with cryptocurrency transactions may be a stabilizing factor for business transactions.

So how does the modern business reconcile itself with the astounding opportunities of a risky, crime-infused, and nonregulated technology? It begins with asking more questions:

- What are the business models that align well with your business?

- How do you move cryptocurrency from a private, peer-to-peer dominated space to enterprise functionality?

- How do you separate the legitimate opportunities from risky, over speculative, or criminal use of cryptocurrency?

- How do you secure cryptocurrencies (or do cryptocurrencies even need securing)?

- Who can establish governance requirements and technology standards to enable successful leveraging of cryptocurrencies by enterprises?

Be on the lookout for future blog posts that consider these questions, and be sure to check the agenda of the European Identity and Cloud Conference (EIC), coming up in May.