‘Know your customer’ started as an anti-money laundering (AML) initiative in the financial industry. Regulators insisted that banks establish a customer ‘due-diligence’ processes to ensure that all bank accounts could be traced back to the entities that owned them. The intent was to make it difficult to establish a business to re-purpose money from illegal activity via a legitimate commercial activity. But while they focus on AML regulation, banks often miss the opportunity to know, and serve, their customers.

Increasingly businesses are realizing that the demographics of their customers are changing. It’s moving away from the ‘baby-boomers’, who are focused on value, to ‘millennials’, who are focused on experience.

Baby-boomers have grown up in a relatively stable environment, with a stable family life and long-term employment. They value ‘best practices’ and loyalty. Millennials, those coming-of-age at the turn of the century, have experienced a much more fluid upbringing. Their family life has been fractured and inconsistent and they have no expectation, nor desire for, long-term employment. They are more interested in flex-time, job-sharing arrangements and sabbaticals.

More importantly, millennials want experience over value. They are less concerned with what they pay for something than they are in their experience in purchasing it. They will not tolerate a bad experience whether it be in-store or on-line. And they have the technology to let others know about their experience.

There’s two approaches to this situation: become despondent and despair of ever attracting this market sector, or consider the vast opportunity of hundreds of millennials posting and tweeting about the fantastic service they experienced when they did business with you.

Coming from Knowing to Serving

So – how do we ‘serve’ our customers? Firstly, we need to know them and then we need to align our marketing practices to them.

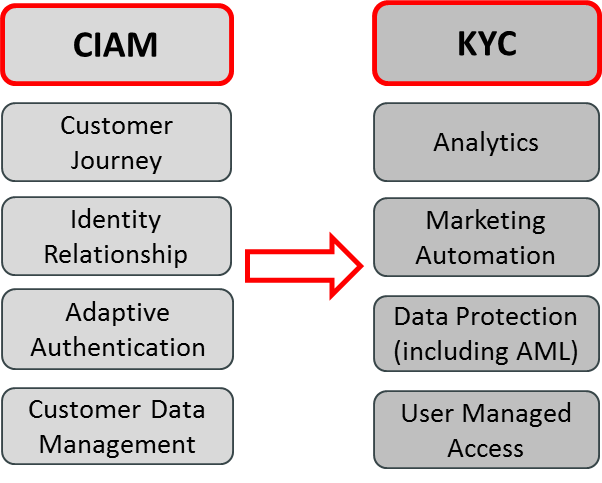

Knowing them requires us to build a picture of our customer base and segment them into groups according to their propensity to purchase our products and services. This will likely require an analysis of CRM data and potentially doing some big-data analysis of customer transaction records. Engaging a Cloud service provider and using their Hadoop services and map-reduce functionality may assist. The intent is to build a customer identity management service that can be used for product/service development and automated marketing. Customer analytics and deploying user-managed access i.e. providing users control of their data and management of their transactions with your organisation, are enabled by a good customer identity and access management (CIAM) facility.

Once we know our customers we can tailor our marketing program to ‘serve’ our customers. This means that we need to modify our product or service to suit their requirements. There is no point in offering something that they don’t want, and you can’t rely on history; as the baby-boomer segment must inevitably decline their purchasing patterns becomes irrelevant. Millennials will gladly tell you what they want if they are asked, putting some effort into understanding them will not go un-rewarded.

Pricing must also be commensurate with the product or service being offered. As noted earlier millennials are far less price-conscious than baby-boomers so a ‘differentiation’ strategy is advised. Make your product or service special, and charge for it.

Promotion should also be targeted too. Hardcopy media is of little use. Focus on social networks and on-line advertising. Google AdWords do work and it can be money well-spent. Make sure your website is responsive, millennials are lost on anything bigger than a 12cm screen.

There is no doubt that doing business is becoming much more interesting. The potential for attracting new customers has never been greater and the opportunities are vast. The only question is “are we agile enough to exploit it?”