Usually, when we talk about special compliance and legal requirements in highly regulated industries, usually one immediately thinks of companies in the financial services sector, i.e. banks and insurance companies. This is obvious and certainly correct because these companies form the commercial basis of all economic activities.

Although regulations and their obligations are often formulated on a relatively abstract level, they must be adapted over time to the changing business and technical circumstances. Sometimes they need to be made more concise, more actionable and more specific, to improve their effectiveness. The BaFin (the German Federal Financial Supervisory Authority or "Bundesanstalt für Finanzdienstleistungsaufsicht) as the regulator for the financial services businesses in Germany has recently updated and extended its set of requirements documents. The "Supervisory Requirements for IT in Financial Institutions” (“Bankaufsichtliche Anforderungen an die IT - BAIT" in 2017 detailed the IT-related requirements of §25 KWG (the German Banking Act =„Kreditwirtschaftsgesetz“) and MaRisk ("Minimum requirements for risk management"=”Mindestanforderungen an das Risikomanagement") for the banking sector. An updated version of the BAIT has been subsequently supplemented by specific requirements for critical infrastructures (KRITIS) in this essential sector.

Quite recently as a second step, the BaFin has provided comparable specific requirements for the insurance industry by publishing the "Versicherungsaufsichtliche Anforderungen an die IT" (VAIT) ("Supervisory Requirements for IT in Insurance Undertakings". Both BAIT and VAIT describe what BaFin considers to be the appropriate technical and organizational resources for IT systems. Ultimately these requirements are also used as the benchmarks for audits.

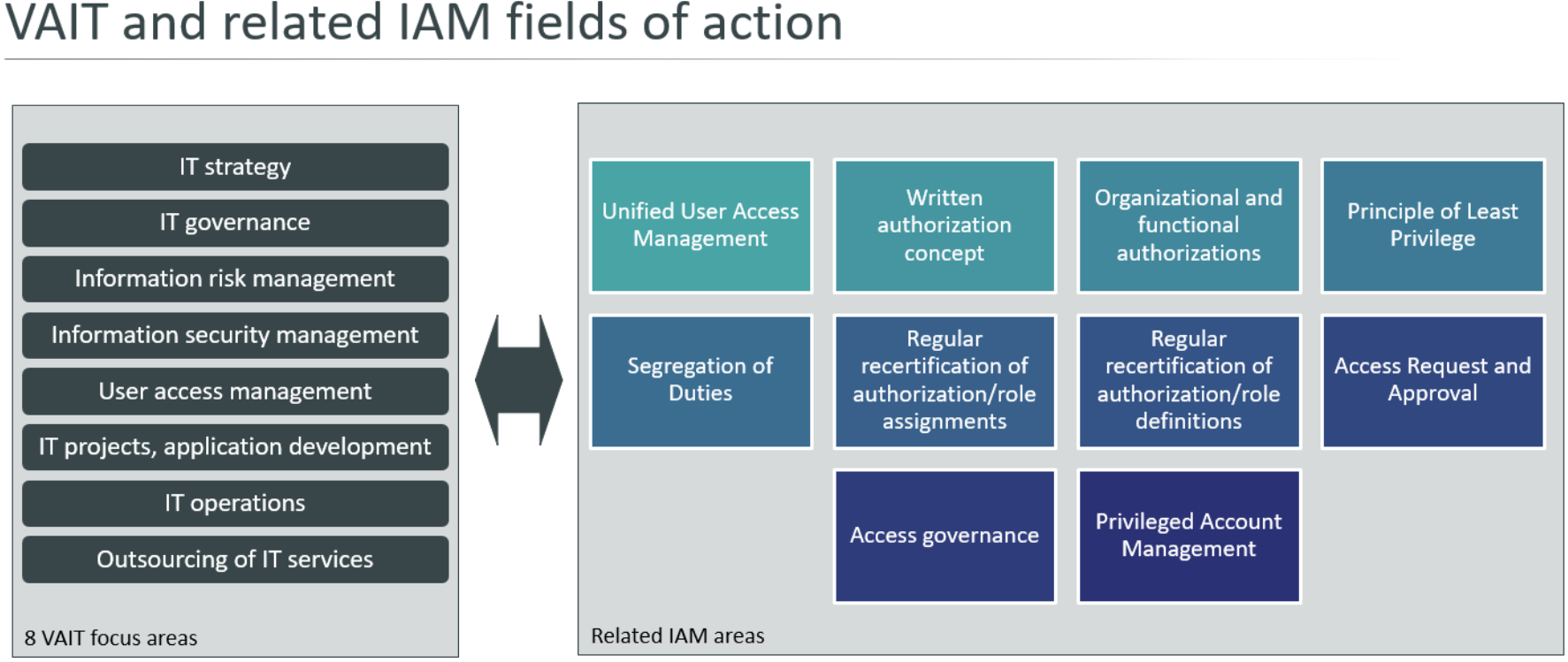

Let’s look at VAIT as an example. Eight focus areas require appropriate consideration and the involvement of suitable stakeholders and experts: Specific guidelines for IT strategy and IT governance define minimum requirements for guidance and implementation in these areas within the organization’s structure and processes. The concept of information risks and their management is integrated into the overall corporate/business risk management. Information security is strengthened by the demand for a widely independent information security officer. With the demand for a uniform authorization management, access management and governance are moving even more into the focus of the auditors. The focus is also on IT projects in addition to traditional IT operations. Application development must now move towards "security by design", to meet the requirements. Outsourcing, the use of third-party services as well as the cloud services that are gradually becoming more relevant are considered part of the "IT services" focus area. Speaking from real life experience: improvements in identity and access management, privileged account management and access governance have proven to be successful controls to implement BAIT and VAIT requirements effectively and measurably. In turn, BAIT and VAIT can provide an excellent justification for finally implementing the improvements to IAM/IAG that have long been needed.

So, the obvious question is who should care about these German regulations for financial services? If you are an insurance company or a bank with a subsidiary in Germany, there is no question about that. Banks and insurance companies face substantial challenges to implement these very concrete requirements into business practice without delay. They must be implemented appropriately, transparently and in a well-documented way by the companies within their scope. (Talk to us, we can help you.)

But what if your organization is not directly in the scope of these regulations? Why not consider them as a benchmark that could help you to increase your organizational maturity. Both BAIT and VAIT are freely available published in English on the Internet. They provide all organizations, even those outside of the financial sector and outside of Germany, with a set of well-elaborated requirements for trustworthy IT. You can use these as a challenge against which to judge the quality of your own overall security and compliance. Going beyond the regulatory requirements as a way to improve your own policies, organization and processes.

And yes, talk to us, we can help you.